Credit risk

Protected in principal

structured credit

Hall of FAME

hall of fame

Markit launches credit portal

credit tech

The Latin quarter

Latin America

Sponsor's article > Counterparty risk – the next generation

Discussions continue on allowing the use of simulation-based estimation methods for counterparty credit exposure under Basel II. In the meantime, however, industry practice has continued to advance. David Rowe argues we should at least move regulatory…

CDOs The growth of structured credit

cdo market

Sunil Hirani

q&a

Balancing currency and credit risk

Contingency swaps

German banks get to grips with a new lending reality

Removal of state guarantees and pressure from shareholders for better returns means German banks can no longer churn out uneconomically priced loans to clients. Now they are starting to introduce sophisticated loan pricing systems, writes Duncan Wood

From Basel II to Basel III

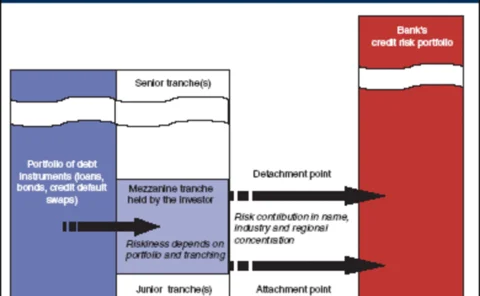

Financial institutions face major challenges in modelling credit portfolio risk, particularly in the field of CDOs. Walter Schulte-Herbrüggen and Gernot Becker argue that the main challenge will be in model testing, due to the increasingly customised…

Fixed income managers search for riches as standard products fall flat

SPECIALIST FIXED INCOME

Estimating default correlations using a reduced-form model

Credit risk : Cuttingedge

From Basel II to Basel III

Portfolio risk

High-yield CDS Building liquidity

credit default swap market

CDOs: the growth of structured credit

CDO market

Groundhog year

chart of the month

Janet Wynn

profile

German banks get to grips with a new lending reality

Loan pricing systems