This article was paid for by a contributing third party.More Information.

Why Basel’s push to overhaul PFE is a wake-up call for risk teams

As Basel reforms reshape counterparty credit risk (CCR), Quantifi’s Dmitry Pugachevsky highlights the imperative for banks to enhance potential future exposure (PFE) calculations

The collapse of Archegos exposed deep cracks in how banks measure CCR – particularly in the calculation of PFE. In response, the Basel Committee on Banking Supervision issued a consultative document calling for a major overhaul, recommending the use of more sophisticated techniques such as wrong-way risk (WWR) and jumps-at-default – methods traditionally associated with valuation adjustment (XVA). While the final guidelines scaled back some of the initial proposals, the message to risk teams is clear: siloed, outdated approaches to PFE are no longer fit for purpose.

This feature explores the regulatory push, lessons from Archegos and why a unified PFE/XVA framework is rapidly becoming the new standard.

Basel’s consultative push: strengthening PFE through WWR and jumps

The Basel Committee’s April 2024 consultative paper on CCR marked a pivotal moment for how banks approach PFE. Citing high-profile failures in risk measurement, the Basel Committee identified shortcomings in standard PFE models – particularly their inability to capture tail events and credit dependencies. One example involved a broker-dealer exposed to Archegos that suffered a $1 billion loss, despite their PFE models showing no exposure at all.

As a result, PFE received the most substantial attention in the document. It was given its own dedicated section and was mentioned 31 times, in contrast to only two mentions of XVA. Crucially, the document explicitly states that PFE should be calculated using sophisticated Monte Carlo simulations, incorporating advanced features such as WWR and jumps-at-default. The recommendation to include jumps is particularly emphasised, considering that PFE is typically used over short horizons where the impact of sudden default events is more pronounced.

Other factors such as longer margin periods of risk, leverage, concentration and liquidity were also discussed. Although these are difficult to quantify precisely, the document advises that banks should estimate and assess these risks through rigorous stress-testing.

WWR: spotlight from Basel and the Archegos Collapse

When comparing the specific risks addressed in the Basel Committee’s consultative document, WWR clearly takes centre stage – it is cited 28 times in both its specific and general forms. The document states explicitly that “institutions should have a dedicated WWR framework” capable of analysing and mitigating this type of risk.

To recap, the main Basel III text defines WWR as a situation “where the exposure increases when the credit quality of the counterparty deteriorates”. WWR is categorised into two types, each with different regulatory implications:

- Specific WWR (also referred to as trade-specific WWR) arises from features unique to individual trades

- General WWR reflects broader relationships between the counterparty’s creditworthiness and macro or market factors.

The collapse of Archegos and the resulting losses at Credit Suisse are a textbook example of specific WWR. As Archegos incurred massive losses on its highly concentrated equity positions, such as its $5.1 billion exposure to ViacomCBS as of March 22, 2021 – its risk of default increased. At the same time, its equity swaps with Credit Suisse, which were both long-dated and highly leveraged, were gaining in value from the bank’s perspective. This led to a dramatic spike in exposure: variation margin demands soared from $177 million on March 24, 2021, to $2.5 billion the next day. When Archegos failed to meet the margin call, it defaulted, leaving Credit Suisse with a $5.5 billion loss.

Effectively modelling WWR requires an understanding of the counterparty’s credit dynamics, particularly the volatilities of, and correlations between, the counterparty’s credit quality and other market factors. However, such parameters are absent from standard PFE calculations, which do not incorporate counterparty default probabilities or the dependency structures that define WWR. This is one of the key limitations the Basel document aims to address.

Jumps-at-default: from theory to implementation

However, in the case of Archegos, calculating WWR alone would not have been sufficient to capture the full risk of loss. The Basel consultative document specifically recommends incorporating jumps-at-default into PFE calculations to address this gap.

In Quantifi’s advanced XVA system, the implementation of jumps-at-default is highly flexible. Any market factor, such as interest rates, foreign exchange, equity or credit, can be configured to jump at the moment of counterparty default. The size of the jump is user-defined and can be specified as a relative, absolute or targeted value.

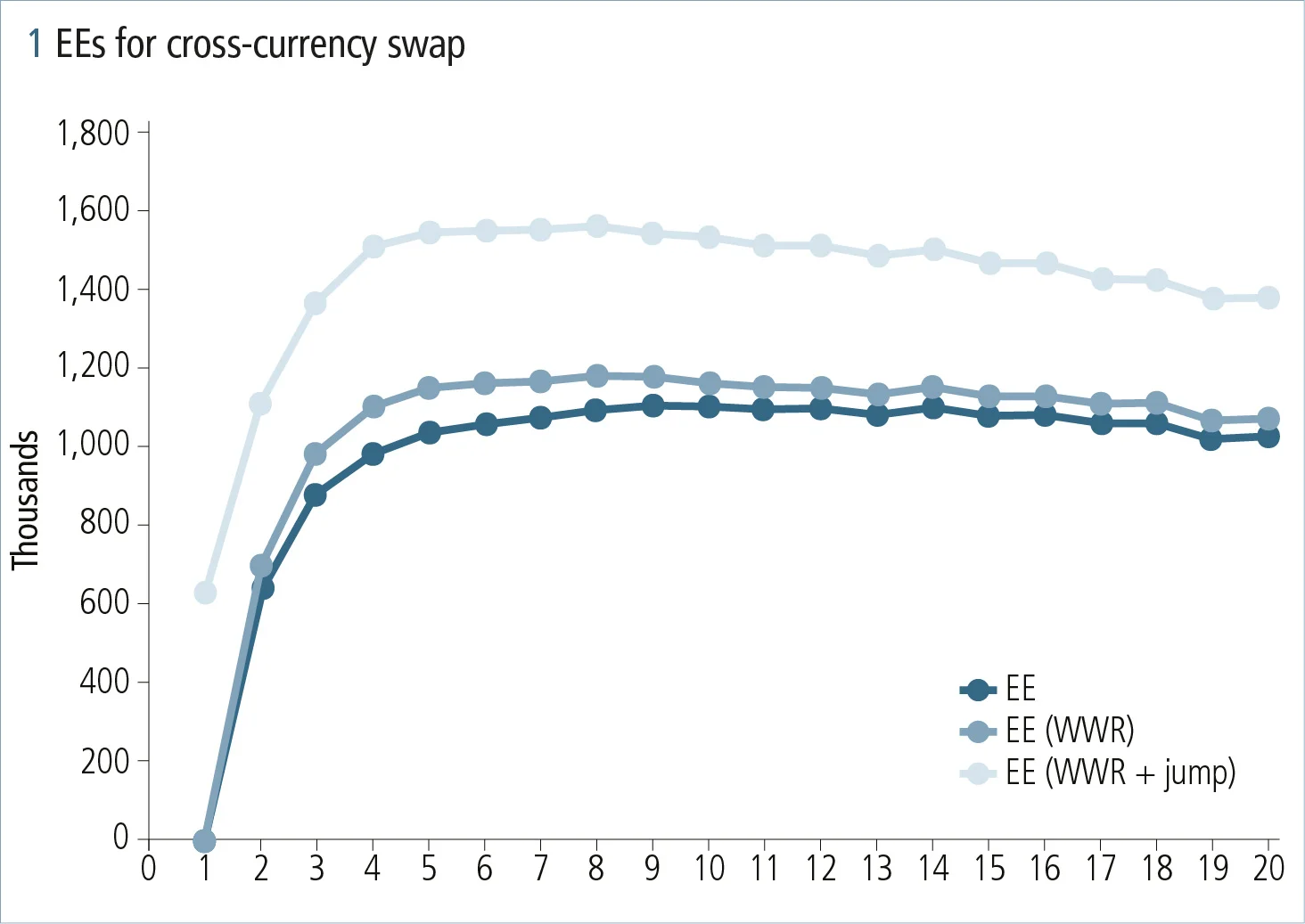

An illustrative example highlights the combined impact of WWR and jumps. Consider a five-year, at-the-money, non-resettable cross-currency swap with a $10 million notional.

- The regular credit valuation adjustment (CVA) for this trade is -1.5% of notional.

- Introducing WWR increases the CVA by 6% to -1.6%.

- Applying a 5% FX devaluation-at-default increases the CVA by a further 35%, bringing it to -2.15%.

Figure 1 shows the expected exposures (EE) over time for all three cases: baseline (regular), with WWR, and with WWR plus 5% devaluation-at-default. It is worth noting that the effect of WWR could be even more pronounced, depending on the volatilities of the FX rate and the counterparty’s credit, as well as the correlation between them.

With the Basel Committee’s recommendation to incorporate WWR and jumps-at-default, PFE systems are starting to resemble XVA systems more closely. Quantifi has long advocated that PFE and XVA should be calculated within a single, unified system using consistent assumptions. However, in practice, most banks have maintained separate systems for PFE and XVA, largely due to historical and organisational reasons.

In fact, even among the largest institutions, not all XVA systems fully support WWR or jumps-at-default – let alone PFE systems, where such features have been almost entirely absent. The hope now is that regulatory pressure will compel banks to implement these capabilities in both frameworks or, ideally, to converge to a single platform that supports both PFE and XVA comprehensively.

Basel final guidelines: a step back or strategic realignment?

In January 2025, the Basel Committee published the final guidelines for CCR management.

Compared with the original consultative document, the final version reflects significant pushback from the industry, particularly regarding the inclusion of WWR and jumps-at-default in PFE calculations. Notably, the entire original paragraph 53, which mandated WWR as a required component of PFE, has been removed. While WWR is now mentioned even more frequently – 29 times in the final version – it appears mostly in the earlier section on general exposure metrics rather than in the PFE-specific guidance. Similarly, references to jump risk in paragraph 51 have also been deleted.

As discussed, incorporating WWR into a PFE framework presents particular challenges, especially since many PFE systems do not even model basic counterparty credit characteristics. There was hope that the Basel Committee’s proposals might encourage the industry to adopt or expand the use of XVA systems, where counterparty dynamics are more fully captured and WWR modelling is standard. However, it appears that many banks are still not ready to merge their XVA and PFE frameworks into a unified approach.

Industry sentiment: are banks ready for a unified system?

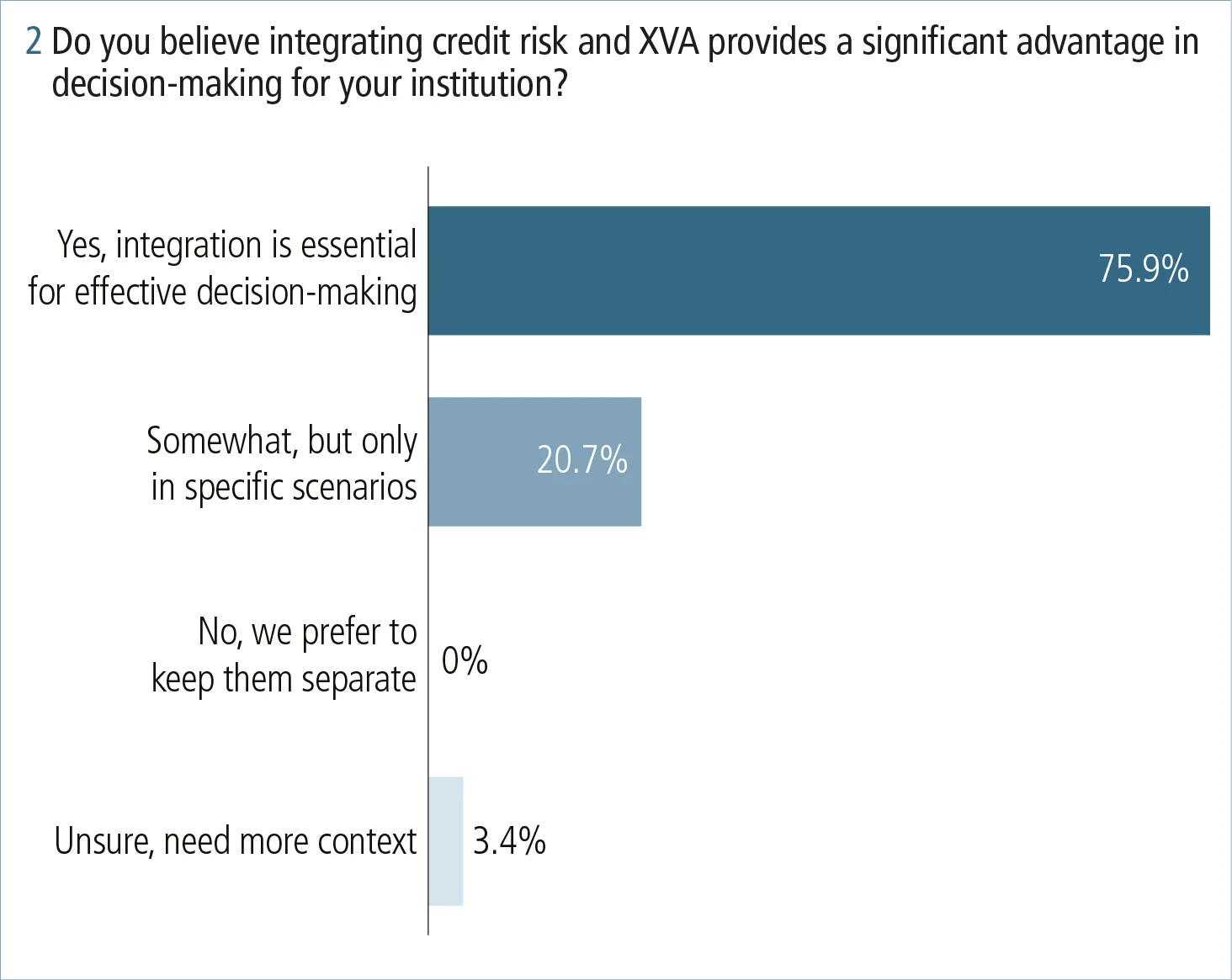

Nevertheless, the tide appears to be turning. A poll conducted during the Quantifi & Risk.net webinar, Achieving a holistic view of credit risk and XVA, in December 2024 revealed that 76% of respondents see significant synergies in calculating PFE and XVA together, while only 3% disagreed or were unsure.

It seems that many banks are increasingly willing to overlook the distinction between real-world and risk-neutral measures when calculating PFE, primarily due to the complexity of calibrating models under the real-world measure.

Another reason this distinction is often ignored is that PFE is not a monetary metric like CVA. Its primary function is to support limit setting and enable comparisons of exposures, whether across days or business units. Since the absolute value of exposure is less critical than its relative size, adding a consistent market price of risk to all exposures has minimal impact on these relative comparisons. This makes it easier for banks to justify using the risk-neutral measure across both PFE and XVA.

Quantifi: a proven platform

Quantifi offers a robust, high-performance Monte Carlo engine that supports advanced features such as WWR and jumps-at-default, and is used for XVA and PFE calculations.

Recently, we’ve seen growing demand from banks to implement PFE within the same system as XVA, using a shared calibration for market factors. This unified approach simplifies implementation, improves consistency and effectively eliminates concerns about measure differences in PFE.

Interestingly, integrating PFE into an XVA framework introduces additional challenges that require the sophistication of an advanced system like Quantifi’s. These include:

- Adding new types of trades to XVA: for example, interest rate and bond futures, and futures options. This is due to calculating PFE on portfolios of trades with exchanges. One peculiar feature is that futures prices have ‘basis’ to simulated model prices, which is not part of a regular pricer.

- Tail risk behaviour: because PFE is a ‘tail’ calculation it might be more unstable than CVA, which is an ‘expectation’. This requires additional tests, the ability to run Monte Carlo with different sets of random numbers and, potentially, the application of variance reduction techniques.

- New or expanded CCR metrics – some CCR metrics are expanded or are newly added, such as potential future bilateral exposure, which is collateral-level calculation for present value and not for EE.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net