Risk magazine - Jan 2022

Articles in this issue

Covid isn’t killing corporate entertaining – it’s dead, anyway

For a generation of bankers and vendors, client hospitality was part of life. But the party is winding down

Down but not out: US Libor trading continues amid ban

Outgoing rate hits market share lows in US swaps but little dent made in listed markets

Bank-run fund derivatives platforms hit records

JP Morgan’s Nexus has seen balances double, while AUM on UBS’s Neo have tripled

EU’s IM model validation rules may put Simm in jeopardy

Draft RTS creates validation hurdles and cross-border conflicts, industry warns

Buy side turns to extreme value theory to spot tail risks

Asset managers reappraise decades-old technique to gauge downside risks amid fears of volatile 2022

People moves: Ice rings changes, new CFTC appointees, and more

Latest job changes across the industry

The bank, the vendor, the turrets and the golf day

After DBS switched supplier, a row broke out, raising questions about entertainment and influence

Review of 2021: Default, revolt, reform

Archegos, GameStop, the last days of Libor – markets just about coped in a bleak and disorderly year

Language barrier: quants slog to teach investing bots to read

Training models to interpret text can be dull; doing it badly can be costly

SA-CCR brings little succour for FX dealers and clients

Spreads on swaps and forwards likely to widen as banks adjust to capital-intensive regime

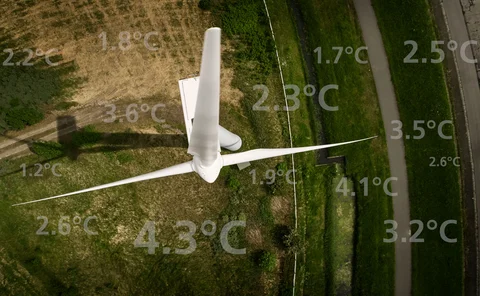

MSCI’s temperature scores stir angst among green investors

Ratings firm says world’s biggest wind power company will produce more global warming than Shell

Clouding the issue: blurred lines divide banks and servicers

Banks clash with big three cloud service providers over data security and configuration errors

Quantum computing: kryptonite for bitcoin and cyber security

Race is on to secure new encryption algorithms for DeFi, before quantum computers become a present danger

Back in the New York groove: BNY CRO’s risk revamp

Veteran risk manager and former trader on “intelligent” risk-taking

Europe swap dealers eye London return post-Brexit

Proposed Mifid exemption paves way for BNP Paribas, SocGen and Deutsche to trade swaps on UK venues

Investors question fixes for a quant strategy that’s stalled

Banks are revamping intraday trend strategies; buy-siders aren’t sure it’ll work

EU offers reprieve for fund-linked derivatives trades

Banks hope FRTB draft allowing fund managers to supply standardised inputs will cut risk weights

Regulators moot public utility to tackle FX settlement risk

Idea floated as battery of initiatives vie to address slowing use of PvP services

SEC stock loan disclosure plan won’t make markets more equal

The GameStop saga showed that securities lending is opaque. New rules are unlikely to improve things

US mutual funds paused inflation bets in Q3

Counterparty Radar: Uncertainty over inflation appears to have dampened trading activity

Interest rate swap activity surges ahead of Fed tightening

Counterparty Radar: Managers react to fastest rise in inflation in three decades

Pimco, Capital Group lead expansion of index CDS market

Counterparty Radar: Total positions reach new high driven by growth of swaps referencing CDX NA IG

Morgan Stanley on heels of Goldman in Q3 CDS data

Counterparty Radar: Sold protection, corporate names fuel growth in US funds’ single-name books

Morgan Stanley solidifies forwards lead as Citi and BNP slip

Counterparty Radar: Non-G10 pairs regain momentum despite dip in total positions in Q3

JP Morgan flies into top FX options spot

Counterparty Radar: Renminbi/US dollar trades also keep Morgan Stanley IM in front

NSCC’s year of living dangerously

The CCP’s models are falling short time and time again, and the consequences could be disastrous

NSCC’s liquidity pool twice short of payment obligation in Q3

The CCP reported a shortfall in its qualifying liquid resources for the third consecutive quarter

Some EU banks keep underprovisioning for ECLs

Divergences between accounting and regulatory markdowns remains high at some top lenders

CME turns to Fed in rejig of liquidity pool

Central bank balances accounted for more than 70% of the CCP’s total liquidity buffer in Q3

Spanish regional bank’s CVA charge up 30-fold on SA-CCR

Banco de Crédito Cooperativo saw end-June charges balloon the most year-on-year across a sample of 120 European banks

SMFG reports highest power sector emissions intensity

Across all systemic banks, only eight dealers disclose their GHG emissions for this field

What quant finance can learn from a 240-year-old problem

Optimal transport theory offers a data-driven way to calibrate derivatives pricing models

Optimal transport for model calibration

Volatility models and SPX/VIX joint dynamics are calibrated using optimal transport theory

Nonlinear risk decomposition for any type of fund

A risk decomposition by fund manager, factor or instrument is proposed

Rising inflation may spare smaller middle-market lenders

PennantPark bets that picking the right entrepreneur can protect private credit from rising prices