The Americas

It takes two: bilateral price streaming takes hold in govvies

Large dealers offer direct API access to government bonds as alternative to request-for-quote trading

BrokerTec Chicago goes live, targeting RV traders

New venue aims to wrestle cash leg of Treasury-futures basis trades from streaming venues

Steepener exits leave traders in search of direction

Uncertainty clouds US rates market as hedge funds pare back steepener positions

Calamos’s $200m inflows trigger autocall ETF ‘frenzy’

First mover expands to US tech, Innovator ETFs plans rival listing on September 25

North American banks outpace Europeans in ERM

New research shows US, Canadian banks have more developed enterprise risk management functions

Banks treat ERM as compulsory – even when it isn’t

More than 80% follow supervisory guidance or expectations for ERM, benchmarking shows

Sharper economic picture sets scene for dollar swaps rebound

Razor-thin bid/offer spreads and slim post-April trading volumes give way to an uptick in August

Future proof: can FMX-LCH platform prevail?

A year into FMX Futures Exchange, Treasury futures volumes are low, and firms aren’t cross-margining

Is 2027 the new 24-hour trading target?

Slew of technical issues and dearth of SEC staff compound exchanges’ reluctance for round-the-clock equity trading

As Fed meets, hedge funds buy ‘lottery’ FX options trades

Options bets reflect cautious pessimism over the dollar ahead of Jackson Hole conference

Niche FX crosses pop up in mutual fund options activity

Counterparty Radar: Fund filings reveal unusual FX options crosses – some never repeated, many with unclear strategies

FICC’s new clearing model sparks praise – and intrigue

Some think collateral-in-lieu concept could be applied to a wider range of trades, beyond MMF repos

Cuts and points – how the Dealer Rankings work

Dealer Rankings 2025: We have a simple way to compare dealers. Sort of simple, anyway

Choosy dealers search for their sweet spot

Dealer Rankings 2025: No bank appears in every top 10 list, as data reveals shifting strengths

OTC books grew in 2024 but remain below peaks

Dealer Rankings 2025: US fund and insurer books were larger in 11 of 16 markets

Opportunity knocks as big US dealers step back

Dealer Rankings 2025: Third annual exercise shows top US dealers are less dominant, allowing Barclays and others to strengthen

Why Calamos chose swaps for market’s first autocall ETF

Swap-based structure attracts $40 million in first month; backers eye multi-billion-dollar AUM

Op risk data: GVA and Nobitex in geopolitical risk strikes

Also: UBS chief a target of third-party data hack, internal bank frauds in Asia. Data by ORX News

Tidal rides retail boom to lead in single-stock options

Counterparty Radar: Volatility-selling ETF firm accounts for half of trading among US funds

Mutual funds were USD bulls going into April’s tariff chaos

Counterparty Radar: Positioning in Q1 reflected market sentiment that tariffs would lead to a dollar rally

Former regulator urges new approach to AI explainability

Ex-OCC chief Michael Hsu suggests shift from academic analysis to decision-based techniques

Investors hope US rate cuts will lower FX hedging costs

European investors in US assets set to boost hedge ratios as implied yields rise

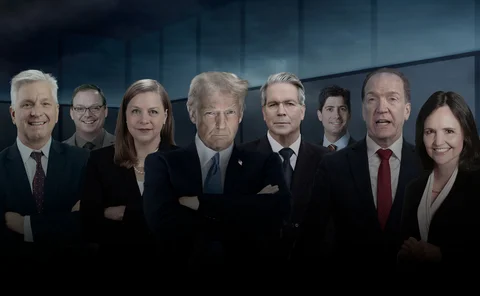

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

NY Fed’s push for repo haircuts gets a tepid response

New risk management standards could make it harder to finance US Treasury purchases