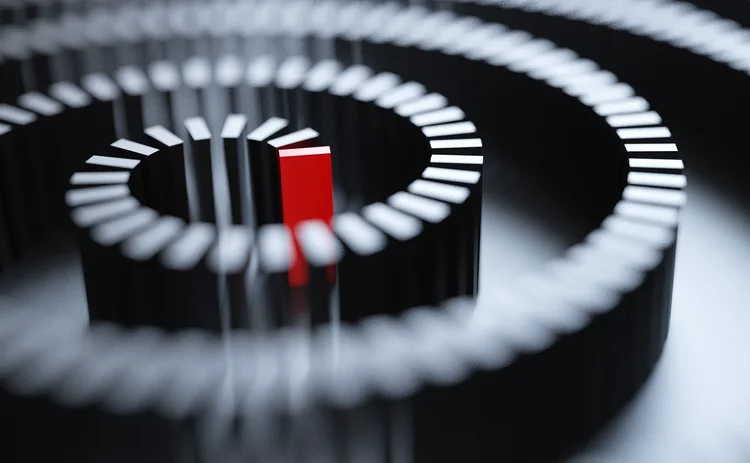

Former regulator urges new approach to AI explainability

Ex-OCC chief Michael Hsu suggests shift from academic analysis to decision-based techniques

Former acting US comptroller of the currency Michael Hsu has called for banks and regulators to rethink how they handle the explainability challenge around large language models. He wants to see them take a more decision-focused approach that exploits the unique nature of LLMs.

Explainability – the ability to follow the logic that leads to the outputs from artificial intelligence – has been one of

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Allocating financing costs: centralised vs decentralised treasury

Centralisation can aid capital efficiency and ROE, particularly in collateralised financing, says Sachin Ranade

EVE and NII dominate IRRBB limit-setting

ALM Benchmarking study finds majority of banks relying on hard risk limits, and a minority supplementing with early-warning indicators

Banks split over AI risk management

Model teams hold the reins, but some argue AI is an enterprise risk

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics

New EBA taxonomy could help integrate emerging op risks

Extra loss flags will allow banks to track transversal risks like geopolitics and AI, say experts

Third of banks run ALM with five or fewer staff

Across 46 firms, asset-liability management is usually housed in treasury, but formal remits and staffing allocations differ sharply

One Trading brings 24/7 equity trading to Europe

Start-up exchange will launch perpetual futures Clob in Q1 after AFM nod

Credit spread risk: the cryptic peril on bank balance sheets

Some bankers fear EU regulatory push on CSRBB has done little to improve risk management