Bank of England (BoE)

What do regulators need from governments on climate change?

To reduce the number of climate risk scenarios, lawmakers need to start being more specific

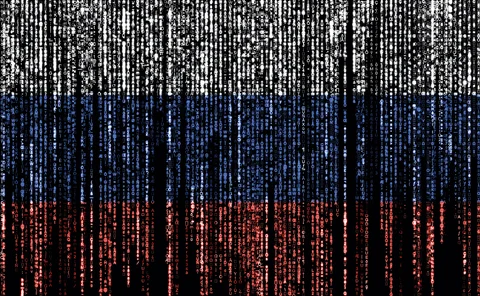

Europe’s banks brace for Russia-backed cyber retaliation

Beefed-up sanctions on Russia’s largest banks spark IT security alert; 100s of computers brought down in Ukraine

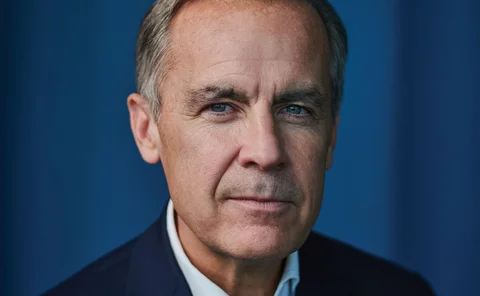

Lifetime achievement award: Mark Carney

Risk Awards 2022: The calm at the eye of the storm of post-crisis regulation and climate risk management

Don’t impose blanket margin model rules, say BoE advisers

Focus instead on outcomes and costs and factor in different clearing membership, say Murphy and Vause

UK banks’ RWAs return to growth

Latest Bank of England data shows first increase since Q1, 2020

UK bank derivatives exposures rose by £38bn in Q3

FX contracts drove the overall increase

Swaps between UK banks and foreign firms up in Q3

Despite latest uptick, gross value of derivatives contracts held by UK banks is 67% below 2008 peak

BoE stress tests: Lloyds just 10bp above minimum CET1 ratio

Bank’s simulated core ratio was just 10bp above requirements at the worst point of a severe recession

Basel turns attention to non-climate-related environment risks

Experts warn of over-complicated framework if nature-related risks are added prematurely

BoE hints at retaliation if EU derecognises UK clearing houses

Warning follows release of new BoE proposals for assessing foreign clearing houses

Buy-side rates traders staying on sidelines after wild October

Funds cautious after staggering collapse of the year’s steepener trade

Banks seek regulatory guidance on climate transition plans

Lack of agreement on how to identify whether borrowers are converging with net zero targets

Operational resilience: charting evolution, strengthening impact

Arming a business in preparation for robust operational resilience measures is not a one-step solution – it continues to evolve. The key to strengthening defences against all events – especially the unlikely but plausible – is to build business agility…

Show, don’t tell, on op resilience – Fed examiner

OpRisk North America: banks warned of “disconnect” between theory and practice

BoE calls for changes to regulatory reporting

Current reporting methods are too costly and produce “crap data”, senior official says

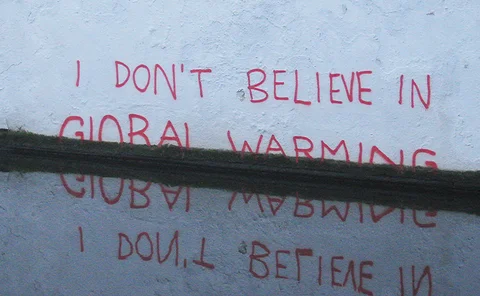

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

Weather, or not: is climate risk just part of credit risk?

Practitioners divided on whether climate risk can fit into existing credit risk weights

Sonia/SOFR swaps jump ahead of ‘RFR First’ initiative

Cross-currency swaps increasingly seeing RFRs on both legs

UK bank derivatives exposures fall by £321bn in Q2

At £1.12 trillion, FX exposures are at their lowest levels for seven years

40% of insurers fail to specify climate as a key risk – LCP

Despite regulators’ urging, many UK and Irish insurers omit climate from risk statements, says report

The unintended consequences of ring-fencing

Rules aimed at protecting UK depositors may be putting too much froth into the credit market

New BoE climate risk scenarios spark race for extra data

Banks need information from clients or third parties to populate 1,760 stress test variables

UK banks’ RWAs near record low – BoE

Lower credit and counterparty RWAs led the quarterly drop, latest figures show