Bank of England (BoE)

Pick a lane: Anna DSB to rival CDM coded swaps reporting?

Dual machine-executable rules are set to create choice – and maybe bifurcation – for swaps reporting

Using correlation to model op risk losses may be unsafe – study

Techniques for linking economic factors and bank losses produce varying – and sometimes contradictory – results

The ghost of Archegos returns to haunt Simm

UK regulator’s attack on Simm may have more to do with the failed family office than meets the eye

PRA’s pot shots threaten Simm’s global ubiquity

UK regulator’s push to improve model governance could tip non-cleared derivatives market into chaos

Mediobanca’s Generali deal revives an old sec lending concern

BoE warns against lending shares to borrowers aiming to influence AGM votes, but will anyone outside the UK listen?

BoE: regulators could push CCPs to publish margin shocks

Russia-Ukraine war has forced a tenfold margin funding burden, says BNP; Ice says smaller hedgers face disenfranchisement

Is DLT post-trade a solution without a problem?

Sources question landmark projects' ability to use technology at scale as further delay besets ASX deployment

Coded swaps reporting plan delights some, but not all

Cost-busting code for swaps reporting could be tricky if banks lack internal standardisation

Corporates boost FX hedges as US dollar surges

Banks see more business, but also rising exposures, from corporates’ FX decision-making

Banks’ loan-loss forecasts diverge in BoE climate exercise

Dispersion of estimates for corporate impairments highlights variety of assumptions for modelling climate risk

Inflation scenarios, pt II: end of the party

Whether inflation rises or falls, crowdsourced scenarios forecast huge range of outcomes

Ukraine crisis ‘made VM three times IM’ on CME commodities

Isda AGM: Margins spiked in April following rises in oil, gas and wheat prices triggered by Russia’s Ukraine invasion

Banks eye ‘nirvana’ in machine-executable swaps reporting

Coded reporting requirements to save banks “millions” in compliance costs

Single climate risk metric ‘not realistic’, says Bank of England

Senior official argues banks and investors must weigh up multiple factors when assessing climate risk

Regulators need to go back to fundamentals on fund risks

Policy-makers need to identify risks posed by open-ended investment funds more precisely

Net zero banks can lend to polluters for transition – Carney

‘Only mainstream finance’ has resources to fund companies to go green

What do regulators need from governments on climate change?

To reduce the number of climate risk scenarios, lawmakers need to start being more specific

Europe’s banks brace for Russia-backed cyber retaliation

Beefed-up sanctions on Russia’s largest banks spark IT security alert; 100s of computers brought down in Ukraine

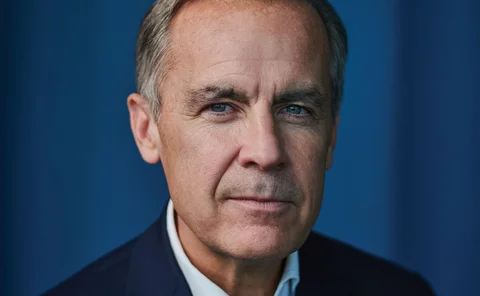

Lifetime achievement award: Mark Carney

Risk Awards 2022: The calm at the eye of the storm of post-crisis regulation and climate risk management

Don’t impose blanket margin model rules, say BoE advisers

Focus instead on outcomes and costs and factor in different clearing membership, say Murphy and Vause

UK banks’ RWAs return to growth

Latest Bank of England data shows first increase since Q1, 2020

UK bank derivatives exposures rose by £38bn in Q3

FX contracts drove the overall increase