News

Japanese investors exit PRDC notes

Late-2005 dollar rally against the yen catches some investors out

Asian growth to boost hedge funds

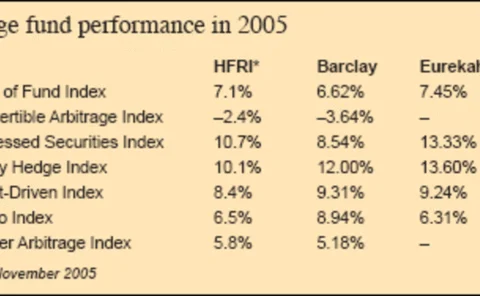

2005 a relatively good year for hedge funds, but convertible arbitrage still down

UK yields pose pension fund problems

New angles

Jade leadership revealed

The Chicago Board of Trade (CBOT) and the Singapore Exchange (SGX) named the chairman and directors of their planned Singapore-based joint venture, the Joint Asian Derivatives Exchange (Jade), yesterday.

Isda launches evergreen novation protocol

The International Swaps and Derivatives Association today launched its updated Novation Protocol II (NPII).

Calyon names energy trading head

Calyon has hired Neil. Rothwell from Dresdner Kleinwort Wasserstein as global head of energy trading.

IIC launches euro iBoxx ABS index

Frankfurt-based International Index Company (IIC) has launched the iBoxx EUR ABS 50 index, which consists of the 50 largest and most liquid AAA-rated European floating rate asset-backed securities (ABS) and mortgage-backed securities (MBS). Each…

New CIO for TSE

LOSSES & LAWSUITS

NYSE Regulation fines UBS $49.5 million

LOSSES & LAWSUITS

Chaos surrounds Qinetiq privatisation

LOSSES & LAWSUITS

NASD charges Oppenheimer and CEO Lowenthal

LOSSES & LAWSUITS

Difficult January for Deutsche Bank

LOSSES & LAWSUITS

A question of trust at State Street Trust and Banking

LOSSES & LAWSUITS

TSE shutdown sparks fury

New angles

Deutsche trader dismissed

New angles

Reinsurers hit capital markets

New angles

New index taps into ABSs

New angles

RiskNews

RiskNews