Infrastructure

Prime broker shortcomings contribute to hedge fund risk

Hedge Funds are incurring extra operational risk as a result of inadequate prime brokerage services, according to TCA Consulting.

ABN’s Mulder calls for faster op risk implementation

Bankers were urged to accelerate implementation of operational risk management practices to better serve their institutions ahead of Basel II by Herman Mulder, senior executive vice-president for group risk management at Dutch bank ABN Amro, during a…

Isda and FpML complete integration

The International Swaps and Derivatives Organisation (Isda) has completed the integration of Financial products Markup Language (FpML) into its organisational structure.

Platts launches US coal derivatives index

Platts, the energy information business and part of McGraw-Hill, has launched a series of coal derivatives indexes in the US to help market participants to price contracts in this developing area of the energy markets.

Isda, FpML.org unveil trial recommendation for FpML 2.0

The International Swaps and Derivatives Association and FpML.org, scheduled to merge at the end of January, have published a trial recommendation for financial products markup language (FpML) Version 2.0.

Boom or bust?

In volatile markets, technology must enable managers to navigate these difficult conditions. Can the current systems feed the market?

UBS in bid to tap retail interest in equity-linked note

UBS Warburg, the investment banking unit of Switzerland's UBS, is negotiating with Hong Kong Exchanges and Clearing to list an equity-linked note released in Hong Kong in November. The move is an effort to generate retail investor interest in the…

Linear, yet attractive, Contour

Banks’ Potential Future Exposure models are at the core of the advanced EAD (Exposure At Default) approach to capital requirements for credit risk considered in the New Basel Capital Accord. Juan Cárdenas, Emmanuel Fruchard and Jean-François Picron look…

In search of clarity and focus

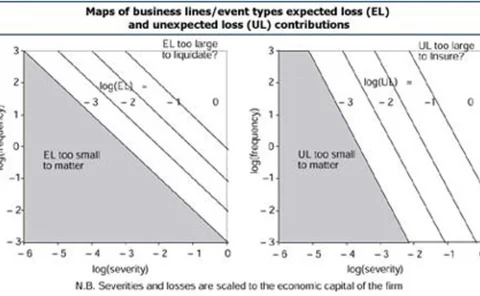

Greater precision is needed in defining operational risk, but the Basle regulators' latest thoughts are lost in generalities, says Jacques Pézier, in the final article of a three-part series.

Basel shortcomings: Danger lurks on the rocky road to Basel II

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

Approach with caution

Indicators of operational risk are not for the faint of heart, nor are they necessarily bearers of good news. But used properly and effectively, they can help businesses identify potential losses before they happen.

The Basel II capital accord: op risk proposals in brief

This summary has been updated to include the revisions to the Basel II op risk proposals contained in the Working Paper on the Regulatory Treatment of Operational Risk issued in September, 2001 and available on the Bank for International Settlements'…

Op risk modelling evolves

Operational risk is devilishly difficult to model, but dealers and software vendors are making headway. Automated op risk reporting, profiling and sophisticated operational value-at-risk (VAR) modelling are finally beginning to catch-on in banks.

Basel II sets the pace for operational risk reform

Basel II is set to come into play in 2005, bringing a host of opportunities for vendors along with the new framework for banking supervision. Andrew Partridge examines the potential and some of the challenges for the suppliers and users of financial…

The Basel Accord: A tough nut to crack

Crafting a capital charge for operational risk has proven to be a project fraught with controversy. International regulators’ first attempt raised the industry’s hackles. David Keefe reports on recent – and further expected – compromises by the Basel…

2002 the year ahead

Market overview

Linear, yet attractive, Contour

Technical

Utilities: Enron’s ripple effect

Cover story

Losses and lawsuits

LOSS DATABASE