Infrastructure

Solving the pensions puzzle

A host of market and structural problems are plaguing US corporate pension plans. Derivatives dealers are pitching a number of potential solutions.

Pinched budgets strain IT decisions

The September 11 attacks and continuing economic downturn have severely affected the global banking industry. Now banks’ IT departments must increasingly justify their build-or-buy decisions in terms of value for money, speed and increased functionality.

Job moves

QUOTE OF THE MONTH: - “Few regulators really understand derivatives... That’s not their fault, many of us don’t either” A London forex trader commenting on AIB’s $750 million loss. Source: The Mirror, February 7

GFInet to unleash derivatives market data feed

New York-based interdealer broker GFInet plans to offer market data feeds for the first time, and is in the process of selecting a feed vendor.

Warburg reshuffles derivatives team and launches UBSWenergy.com

UBS Warburg has named Jonkee Hong as its new head of global emerging market derivatives. Hong, now based in Connecticut after leaving his post as head of Asian derivatives, reports to Raphael Gys, global head of fixed-income derivatives marketing and…

Isda publishes FpML 3.0 specs

The International Swaps and Derivatives Association has released the working draft of FpML 3.0, which aims to increase the coverage of the standardised, electronic language to cover foreign exchange over-the-counter contracts such as forex forwards and…

FT Interactive Data expands forex coverage

FT Interactive Data, a provider of securities prices, has expanded its coverage of spot and forward foreign exchange markets and reduced update times from every hour to every half hour.

Retail banking accounts for two-thirds of op loss events, says Basel survey

BASEL, SWITZERLAND -- Operational losses in retail banking accounted for two-thirds of the number of operational losses suffered by banks, according to a survey by global banking regulators. The survey sought data about the impact on major banks of the…

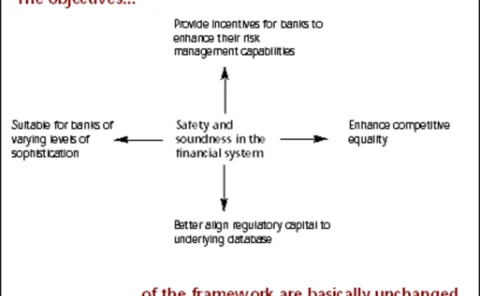

The Basle II capital accord: op risk proposals in brief

This summary has been updated to include the revisions to the Basle II op risk proposals contained in the Working Paper on the Regulatory Treatment of Operational Risk issued in September, 2001 and available on the Bank for International Settlements’…

Loss survey supports arguments against capital charges, say fund managers

London - The results of a survey by global banking regulators of banks’ operational loss experience support arguments against using capital charges as the main protection against operational losses in fund management and broker activities. This is the…

Credit model evaluation

With the new Basel Capital Accord scheduled for implementation in 2005, banks are having to evaluate the credit scoring models that will enable them to meet the minimum standards for Basel’s internal ratings-based (IRB) approach. Selecting an appropriate…

IT and staff quality seen as key as India adopts Basel II

CALCUTTA, INDIA - The need to improve staff quality and use information technology (IT) effectively are among key targets for the Indian banking system as it prepares to meet intern ational standards of risk-based regulation, India’s central bank chief…

On a stronger footing

E-trading

Unlocking ABS value

Cover story

Open practice

Profile

Credit model evaluation

Technical