Infrastructure

FSA examines the feasibility of benchmarking for execution policies under Mifid

The Financial Services Authority (FSA) in the UK has just released discussion paper 06/3, ‘Implementing Mifid’s best execution requirements’. The paper, open for comments until August 17, 2006, will inform the FSA’s approach to Article 21 of the Markets…

NPR release muddies the op risk waters

Operational risk executives are scrutinising the recently released NPR by the US Fed, which, despite clarifying some points, has nevertheless created new contentious issues. Choongo Moonga reports

Mifid IT group spins itself off

LONDON – The Joint Working Group (JWG) of the Markets in Financial Instruments Directive (Mifid) has lost its IT subject group because it has spun itself off as a for-profit think tank, JWG officials confirm.

In the frame

Seven of the industry's top op risk executives debated framework implementation at a recent roundtable discussion in New York, moderated by Ellen Davis and sponsored by enterprise-wide risk solution firm FRS

Dealers dispute benefts of trading algorithms

Algorithms are important but not indispensable in execution trading, said participants at a panel discussion during the fourth Asia-Pacific Electronic Trading Summit 2006, held in Hong Kong yesterday.

Markit acquires derivatives trading technology provider

Markit Group, the UK-based pricing, valuation and data provider, has acquired Communicator, a technology provider of automated solutions for the processing of over-the-counter derivatives, secure real-time communications, and compliance and counterparty…

Crossing the Border

The push for MiFID may drive cross-border consolidation in Europe.

Evolution signs up to SunGard

Evolution Capital Management (Evolution), a $1bn hedge fund based in Honolulu, is implementing SunGard's cross-asset trading platform, Front Arena, to support its enterprise trading, risk management, processing and reporting requirements.

Administrators - the axis in Bermuda's portfolio-pricing triangle

administration in bermuda

Bringing core and satellite approaches to hedge funds

academic paper

Discovering the Americas

Conference report

Bumped along by Basel II

Credit Portfolio Management

Pricing illiquidity in energy markets

Illiquidity is sadly a typical feature of many energy derivative markets. In this paper Stefano Fiorenzani proposes the application of a methodology, originally developed for equity markets, to overcome this problem

Time to get physical

For the second tier of banks wishing to buy physical energy assets, the next two years will be critical. Antony Kakoudakis and Aarzoo Shah consider this trend and examine some of the hurdles newer entrants face

The human touch

Voice broking

Indices and index-based products

9. Indices

Loan derivatives: laying down the law

Leveraged loans

Merger fever hits US telecoms

Telecom sector

Balance sheet and arbitrage CDOs

4. Balance sheet/arbitrage

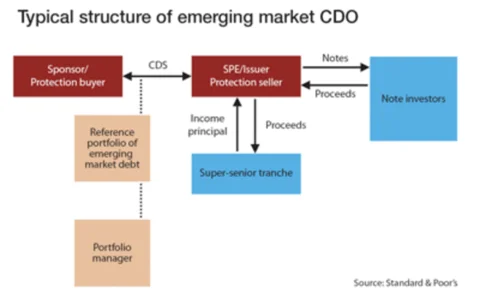

Emerging market CDOs

10. EM CDOs

Diane Vazza

Dalia Fahmy finds out where the head of global fixed-income research at Standard & Poor's in New York found her calling