Cover story

No quick fix for fiduciaries on asset valuations

Fiduciary failings

Curbs on bank trading activity hit liquidity

Squeezing every last drop

A liquid market – banks tap insurers' liquidity reserves

A liquid market

Volatility: the next mainstream asset class?

A volatile time

Are there enough liquid assets to satisfy regulations?

Grease is the word

Special report: Oil market

Special report: Oil market

Gulf One's Rowan: Op risk value lies in strategy

The thinker

Asia Risk awards 2010

Asia Risk awards 2010

Life & Pension Risk - 2010 awards

Life & Pension Risk rewards best practice and innovative thinking in its 2010 awards

Replicating infrastructure exposure with structured products

New directions in infrastructure

Ban on rehypothecation could increase derivatives costs

A number of hedge funds are now insisting margin posted on derivatives trades is not rehypothecated – a trend that could drive up costs

Regulation, liquidity and risk management strategies

Counting the costs

China fast-tracks Hong Kong as offshore renminbi centre

Lighting the way

The battle for retail depositors

The battle for depositors

Mizuho provides a model model for AMA in Japan

Japan’s regulator points to Mizuho Financial Group’s operational risk management model as an example for banks in the country to follow. Shigehiko Mori, the group’s head of operational risk, talks about how the model works and his plans for continued…

Uncertain outcomes – insurers and pension funds tackle inflation risk

With central banks’ discount windows pouring money out at rock-bottom rates but economies still slow to use up excess capacity, the outlook for inflation has never been murkier. Uncertainty has created arbitrage opportunities for inflation risk managers…

Credit investors up in arms over lax covenants

Investors are complaining that documentation for high yield bond deals has become increasingly opaque and poorly structured, making it difficult to gauge the level of risk. Will the glut of high yield supply that is set to hit the market over the coming…

Special report: Energy end-users

Special report: Energy end-users

Dealers ready their resources for Asia commodities push

The bounce in the commodities sector following the financial crisis put a number of dealers on alert about money-making opportunities in Asia. Many leading dealers are amassing their resources in the region, particularly in the physical arena. But do…

Asian banks win important Basel III victory but have little to fear

The amendments of Basel III bank capital and liquidity proposals unveiled in July suggest banks have scored an important victory in their efforts to tone down some of the most onerous requirements being proposed by the Basel Committee. But even without…

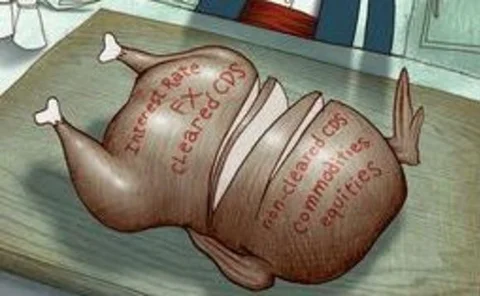

The swaps carve-out conundrum

Section 716 of the Dodd-Frank Act will force swap dealers to hive off certain derivatives businesses into separate affiliates. But the legislation is fiendishly complicated, riddled with oversights and requires daring interpretative leaps, which has left…

ANZ's Page: The op risk manager is the goalkeeper

Chris Page, group head of risk management at ANZ, sees his role as “guardian of the balance sheet” as first and foremost, but is also aware that sometimes he needs to stand his ground on risk issues, as he might be the last man standing between the bank…