Cover story

Partially protected: Dodd-Frank Act spares structured products

Registered advantages

German economy under pressure from bank losses and euro crisis

Bond investors have snapped up German Bunds in recent weeks, with Europe’s sovereign debt crisis triggering a flight to quality. But is Germany really the safe haven it appears? Credit explores potential vulnerabilities in the German economy and assesses…

ETFs: investors’ flexible friends

Exchange-traded funds have proliferated in Europe, offering institutional investors enormous investment choice and liquidity at a low cost. We find out how and why these products are attracting the interest of a diverse range of investors and look at the…

MCEV – the quest for market consistency

After the extreme volatility of 2008 spoiled the MCEV launch party, investors have been understandably wary of the way some firms have taken a hardline stance on market consistency. Now the variance in how non-hedgable risks are assessed is what is…

Sheen: The FSA's go-to guy for op risk

Andrew Sheen at the UK Financial Services Authority has rapidly become one of the most respected experts in operational risk, perhaps due to his clear vision of where the profession needs to go and what it must do to get there.

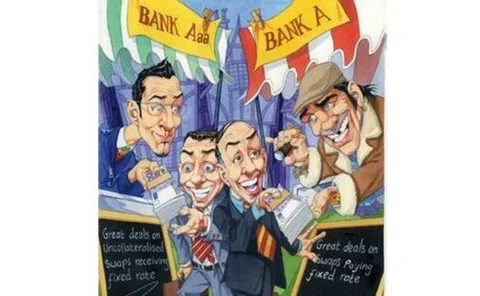

Dealing with funding on uncollateralised swaps

Many banks are now using their own cost of funding as a discount rate when pricing non-collateralised swaps trades. How are banks dealing with the difference in funding rates when quoting derivatives prices, and could this influence a client’s choice of…

Variable annuities face more hedging challenges in Asia

Variable returns

Risk roulette on eurozone scenarios

The European Union and International Monetary Fund agreed a €750 billion emergency loan package in early May, aimed at averting a sovereign default and wider crisis across the eurozone. Nonetheless, banks have been preparing for the worst, stress testing…

Learning to Love Basel II

Introducing a major insurance element to operational risk management processes is a passion for National Australia Bank’s Ross Love.

Debt-ridden Spain and Portugal face new threats to credit status

Clouds are gathering over the Iberian peninsula. Attention is shifting from Greece, given temporary respite by the EU-IMF bailout, to Spain and Portugal as fears mount over their fiscal deficits and spiralling unemployment figures.

Bond ambition – The World Bank’s attempts to launch a longevity bond in Chile

Attempts to diversify longevity risk into the broader financial system have so far focused on using swaps. But in an ambitious move, the World Bank has tried to launch the first ever longevity bond in Chile. Aaron Woolner reports on how successful this…

Hybrid structures tempt investors

Volatile and uncertain markets have got investors thinking about diversified exposures to multiple asset classes both as yield generating opportunities and portfolio hedges. Hybrid structures, which blend discrete asset exposures into one pay-off, are…

Regulatory straitjacket?

South Korea introduced a raft of new legislation with the aim of helping make Seoul a world-class financial centre prior to the financial crisis. But the events of 2007–08 proved a game changer as regulators grappled with the damage wreaked by kikos and…

US power market concern over FERC credit reforms

The US FERC’s recent move to standardise credit policies across the US power market has led some participants to question the application of a ‘one size fits all’ approach across the organised wholesale markets. Pauline McCallion reports

EXCLUSIVE: Greece debt crisis may break the Eurozone

Fears mount over Greece's ability to reduce fiscal deficit and service debt repayments, despite Eurozone-IMF bailout package.

Basel III: kill or be killed

The Basel Committee is trying to prevent a repeat of the financial crisis with a package of new rules, but banks argue the cure could be worse than the disease. After spending the past two months filling out spreadsheets on the impact of the proposals,…

Right place, right time

Eileen Robbins, vice-president in operational risk at the Depository Trust & Clearing Corporation, has a history of turning up just as things are kicking off. She talks to OR&R about the DTCC’s much-lauded handling of the Lehman Brothers collapse, and…

OTC shake-up likely as regulators mull centralised clearing

US legislators are pressing for reforms that will lead to a big shake-up in how over-the-counter derivatives are bought and sold. The question is how this will affect the structured notes market. John Ferry reports

Solvency management provides reinsurance opportunity

Testing economic conditions have prompted widespread moves by life insurers to reinsure their liabilities in order to gain capital relief. As the situation eases, will demand for reinsurance fall, or are other factors coming to prominence? Blake Evans…

Betting on basis

Large offshore capital raising efforts by Australia’s banks and a relative dearth of activity in the kangaroo bond market has led to a significant widening in the cross-currency basis swap. This imbalance has created a large profit opportunity for fund…

Counting the cost of counterparty risk

A few years ago no-one worried about counterparty credit risk. Then a year ago that was all anyone cared about. As markets begin to settle down, the shake-up could have longer-term implications for the structured products market. By John Ferry