Feature

Brexit: banks take the ‘no’ out of novations

Swaps clauses stop end-users blocking counterparty switch, making it easier to move trades to EU affiliates

Basel liquidity rules block Fed’s QE exit

LCR and NSFR could produce $1 trillion shortfall in plans for balance-sheet ‘normalisation’

Energy Risk Commodity Rankings 2018: A surge of energy

Top dealers continued technology push as hedgers fine-tuned risk management strategies in 2017

Vix curve gave warning of February volatility spike

Research by NYU’s Marco Avellaneda offers insight into short-vol strategy

From BAML to UBS: how 15 banks stack up on ‘last look’

Disclosures show striking differences on pre-hedging, hold times and trade acceptance

Shale, pipelines and hubs: turmoil ahead for US gas hedging

Regional market correlations in flux amid structural change

Quants needed: how finance can use power of quantum tech

New machines have big potential in AI, valuations and VAR, but tech giants like IBM need help from practitioners

Top 10 op risks 2018: model risk

Model risk re-enters top 10 amid avalanche of validation regulations

Top 10 op risks 2018: talent risk

Fears over dearth of talent across tech and risk management

Top 10 op risks 2018: organisational change

Banks fear pace of technological change will leave them exposed; others worry they could be superseded altogether

Top 10 op risks 2018: outsourcing

GDPR tipped to spark rise in disputes with third-party vendors

Top 10 op risks 2018: theft and fraud

Cyber theft fears widespread, but old-fashioned frauds dominate losses

Top 10 op risks 2018: unauthorised trading

Banks say threat from rogue algos outstrips that of human traders

Top 10 op risks 2018: regulatory risk

Fed’s cease-and-desist order against Wells Fargo spooks market

Top 10 op risks 2018: IT disruption

Fear of disabling cyber attack trumps risk of data theft

Top 10 op risks 2018: data compromise

Banks fearful of data breach missteps as GDPR looms

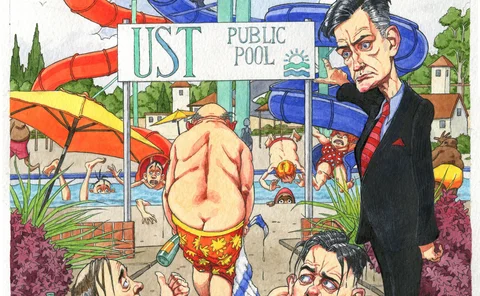

Top 10 op risks 2018: mis-selling

Speculation rife among survey participants over ‘the next PPI’

Softened EU swap stay still threatens margin hike

Moratorium cut to two days, but pre-resolution stay could make EU a non-netting jurisdiction

In the dark: pools warn late Mifid rules still won't add up

Venues say better trade-flagging, consolidated tape needed for equity double-volume caps

Pillar 2 moves to centre stage for op risk capital

US banks set for sharp falls in Pillar 1 requirements, but regulator-set add-ons cloud SMA’s impact

Volatility trap: how gamma roused a market monster

Rates market is exposed to some of the same factors that caused equity volatility to explode in February

One road: China’s new regulatory body begins to unify rulemaking

Micro-issues like netting and securitisation may also be in sights of powerful new committee

Euro swaptions market prepares for pricing revamp

Interdealer market to adopt collateralised cash price from July, but some fear impact on legacy books

Exchanges and FCMs clash over bitcoin clearing carve-out

Market participants say CME, CBOE should clear bitcoin futures separately