Energy Risk - Volume8/No3

Articles in this issue

Scaling the credit cliff

Credit Risk

A clear answer to credit problems

Credit Risk

Cross-border conundrums

Credit Risk

Standing out from the crowd

Credit Risk

Post-delivery problems

Credit Risk

Trying to model reality

Credit Risk

Enron will not centralise risk management

Failed energy trader Enron plans to package together the majority of its internationalassets into a company known as InternationalCo, the shares of which will be distributedto its creditors.

The cost of deregulation

US electricity deregulation does not necessarily make prices more competitive, as is shown in this study of New England power prices by Logical Information Machines

How to run a market

Former-derivatives-trader-turned-author Frank Partnoy wants to see tougher accounting standards and risk disclosures to deter corporate crooks. But are the regulators listening? Maria Kielmas reports

ABN Amro makes global OTC oil and gas drive...

Dutch bank ABN Amro last month started to offer its clients oil and gas hedgingservices, as part of its financial markets business which incorporates debt capitalmarkets, structured lending and risk management activities.

Energy firms turn to overlay

Energy companies face a tough future over pension provisions – a problem that could well exacerbate credit deterioration. Paul Lyon finds that innovative use of currency overlay could provide some form of refuge

Seeking an end to manipulation

Renewed allegations of manipulation of natural gas pipeline capacity in the US have been partly blamed on regulatory complacency. How can regulators put an end to the problems dogging the gas markets? Catherine Lacoursière reports

...while AEP exits Nordic energy trading

Ohio-based American Electric Power (AEP) last month completed its exit from theNordic energy trading market. The management team responsible for AEP’sactivities in the Nordic region will assume AEP’s Nordic trading book,office leases and related…

US power sector decline slows, says Fitch

The US power sector has seen little more than a slowing in the rate of its declinein 2003, said Richard Hunter, managing director of rating agency Fitch’sglobal power group, in May.

People swaps

Chappel replaces McCarthy as Williams CFO US energy major Williams has hired Donald Chappel (pictured) as senior vice-presidentand chief financial officer (CFO). He succeeds Jack McCarthy, who retired atthe end of 2002 after 10 years as CFO. Before this…

Energy firms find succour

US energy company debt has reached critical levels, with nervous investors and banks working hard to keep these companies afloat. But Paul Lyon finds the secretive hedge fund industry could also lend a helping hand

David Mooney

With 34 trading offices active in 40 countries, Swiss commodity trading house Trafigura is no small concern. But while the firm – perhaps best known for its oil, petroleum products and metals trading activities – employs some 600 energy traders worldwide…

Kiodex adds more energy forward curves

Kiodex, an energy risk management technology company based in New York, willadd five new forward curves to its global market data offering, it told delegatesat EPRM’s May congress in Houston.

Ferc calls for risk manager vigilance

The director of the office of market oversight and investigations (OMOI) at theUS Federal Energy Regulatory Commission (Ferc), has urged energy risk managersto alert his office to any suspicious market practices.

Detecting market transitions: from backwardation to contango and back

Svetlana Borovkova looks at detecting market transitions between backwardation and contango states using the forward curve. In this first part of a two-part article, she introduces two change indicators, which she applies to oil futures prices. Next…

CROs seen as vital for restoring confidence

Chief risk officers (CROs) have a vital role in helping shape the future of thetroubled energy sector and should report directly to their company’s boardif investor confidence is to be rebuilt in the industry. Vincent Kaminski, seniorvice-president of…

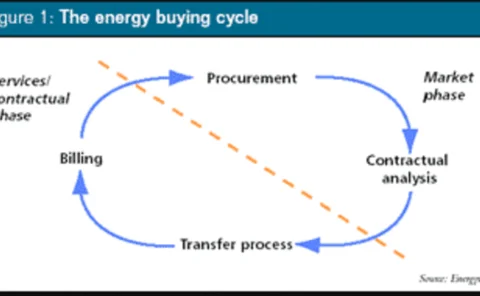

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes