Commodities

Launched in 1994, Energy Risk is an online publication and in-person events company dedicated to the energy risk management and risk transfer business.

Please visit energyrisk.com for more insight and commentary.

Banding together for SME credit risk analytics

Germany’s banking associations are taking a leading role in getting the country’s fragmented banking sector ready to comply with the Basel II capital Accord. Germany’s savings banks association, in particular, says it has internal ratings-based systems…

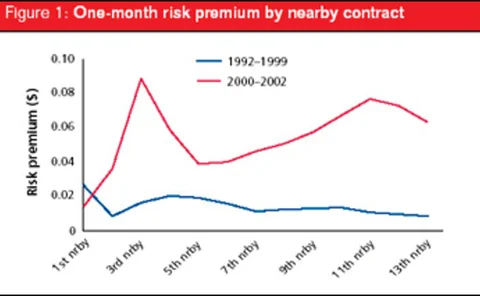

How to gain from risk premia

NATURAL GAS

JP Morgan Chase markets CDO with equity puts in Asia

JP Morgan Chase has begun marketing synthetic collateralised debt obligations (CDOs) with embedded equity put options to a small number of investors in Asia-Pacific. This type of structure is aimed at sidestepping the sometimes-thorny issue of…

Weather risk market remains buoyant, claims Clemmons

The global weather risk market is still healthy, despite high profile departures from the market, speakers told delegates at Risk 's WeatherRisk conference in London today.

Gensec structures first South African weather derivatives contract

ZZ2 Ceres, one of South Africa’s largest fruit and vegetables businesses, has become the first company in the country to use weather derivatives. Its frost protection contract was structured by Gensec Bank, and runs from October 14 to November 30 2002…

There may be trouble ahead

The Harmonic Grid is forecasting an unsettled outlook for the global economy

Optimism is clear in spite of war threat

The crisis in the Middle East is creating a bull market for oil, energy and gold

Credit risk systems: Getting the risk right

The requirements of the new Basel Accord are prompting some banks in Asia to begin implementing sophisticated credit systems, but there are still some obstacles to overcome.

Fimat Futures bulks-up commodities business in Hong Kong

In anticipation of an activity surge in commodity derivatives trading by Hong Kong investors, the Hong Kong arm of international brokerage firm Fimat plans to establish a dedicated commodity trading desk by the end of the year, according to Emmanuel…

Eubank punches for Risk Waters Group's World Trade Center fund

Fancy a pair of boxing gloves signed by former world middleweight champion Chris Eubank? Then put in your bid with a call to Drew Stephens, chief operating officer atSpectron Group, the London energy broker, on 44 207 074 0799.

Economic capital: towards an integrated risk framework

Performance and bonuses are increasingly being assessed on profits after a charge for economic capital allocations. This has increased line managers’ interest in economic capital. As a result, risk managers must ensure that economic capital allocations…

Icap acquires APB Energy

Inter-dealer broker Icap has acquired APB Energy for an initial cash payment of $15.5 million. Further payments, which are contingent on the future earnings of the business, will be made over four years, Icap said. APB brokers gas, electricity, weather…

Avoiding pro-cyclicality

Basel II and SMEs

The credit implosion

Introduction

From Enron to Iraq

The freight derivatives market has ridden out the loss of market-maker Enron, and now all eyes are turning to the effect of military action against Iraq. By Kevin Foster

The credit risk time bomb

Insurers

Reinventing the market

Cashflow CDOs

Taming the FIX connection

With large firms now juggling dozens of FIX connections, industry organizations and vendors are trying to soothe the protocol’s first set of growing pains.

The credit risk time bomb

Insurers remain very keen to both guarantee and invest in credit derivatives products, but key regulators are about to release reports indicating that risk transfer between the insurance and banking sectors might not be such a good idea.