Central banks

Turkish crossover

Turkey

OCC says derivatives revenues, notionals down

US commercial banks’ revenues from derivatives fell by $805 million, to $2.65 billion, from the third to the fourth quarters of 2001, according to figures released yesterday by the Office of the Comptroller of the Currency (OCC).

BNL plans weather desk for Italy

Rome-based Banca Nazionale del Lavoro (BNL) is planning to set up a weather derivatives desk, which could add to the recent thrust of new players in the weather risk market. BNL hopes to establish the desk, specifically for the Italian market, by the…

IKB chooses Trema’s Finance KIT

Trema, a Stockholm-based financial services IT vendor and management consultancy whose clients include the European Central Bank, Deutsche Bundesbank and the Czech Republic’s ING Investment Management today announced that IKB Deutsche Industriebank had…

Weather risk solutions

Germany

At the heart of Europe

Germany

Clearing the way?

Germany

Regulator hits back at Basel II critics

Much of the complexity for which the Basel II bank capital accord is criticised is the inevitable result of three highly desirable features of the pact - namely, risk sensitivity, wide applicability and the shifting of the task of risk measurement to…

Regulators concentrate on key op risk issues for QIS3

Global banking regulators working on the operational risk aspects of the controversial Basle II banking accord are concentrating their efforts on some key issues as they prepare their part of the so-called QIS3 survey.

Disclosure in the dock

Cover story

The Basle II capital accord: op risk proposals in brief

BASLE II UPDATE

Regulators concentrate on key op risk issues for QIS3

FRONT PAGE NEWS

Regulator hits back at Basle II critics

BASLE II UPDATE

Pushing the equities button

The increase in size, diversity and sophistication of the equity derivatives markets has spurred demand for more efficient technology. How are firms responding?

Solving the pensions puzzle

A host of market and structural problems are plaguing US corporate pension plans. Derivatives dealers are pitching a number of potential solutions.

UK to set up 'information clearing house' for disaster recovery

The Bank of England plans to launch a prototype ‘information clearing house’ on disaster recovery for financial firms in the near future, a senior official of the UK’s central bank said.

Dealing with the flak

With the final Basel Accord proposals due to be published later this year, the Bank of International Settlements’ new Asian head, Shinichi Yoshikuni, does not have much time to settle into his new role, writes Nick Sawyer.

IT and staff quality seen as key as India adopts Basel II

CALCUTTA, INDIA - The need to improve staff quality and use information technology (IT) effectively are among key targets for the Indian banking system as it prepares to meet intern ational standards of risk-based regulation, India’s central bank chief…

Unlocking ABS value

Cover story

Second-guessing the rating agencies

Debt capacity advice

A new twist to ABS

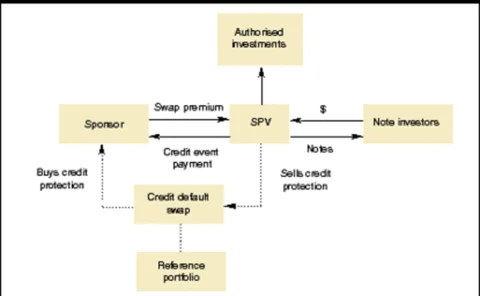

Synthetic securitisation

Down but not out

Non-deliverable forwards