Central banks

The benefits of Enron

Many corporations are keeping a low profile when it comes to their derivatives use. But when the Enron-related witch-hunts are over, companies may find that insurers and shareholders now view corporate hedging as a fiduciary duty

A slow evolution

Credit risk

Looking for value

Convertible bonds

Rates Markets Update: Swap activity dominated by interest rate speculation

Euro swap rates pushed up following increased expectations of an early European Central Bank (ECB) interest rate hike this week. Two-year swap yields rose by around 10 basis points on the week, five-year yields moved up 6bp, and 10-year to 30-year yields…

OTC derivatives volumes up 11%, says BIS

Outstanding notional volumes for the over-the-counter derivatives market stood at $111 trillion at end-December 2001 – an 11% increase from the end of June 2001, according to the latest statistics released by the Bank for International Settlements (BIS).

Risk managers leapfrog lending officers in bank hierarchy, says Greenspan

US Federal Reserve chairman Alan Greenspan said risk managers are now overtaking loan officers in the decision-making hierarchy at financial institutions, with new quantitative risk management techniques a key factor behind this transition.

Rates Markets Update: Swap flows increase on economic news

Dollar-swaps saw big flows this week following a US Treasury announcement on Monday that it plans to borrow $120 billion to cover its budget shortfall. Ten-year swap spreads had come in from 57.5 basis points at the start of the week to 52bp midweek,…

Revamping Corporate Actions

Dividend payments, stock splits, name changes, spin-offs and other corporate actions impacting securities already held in accounts were not supposed to be affected by T+1. But as the deadline for shortening the trade settlement cycle is challenging firms…

Gaining an edge from Basel

The recent recommendations of the Basel Committee are set to usher in a period of upheaval for many participants in the banking sector. Standard & Poor’s Anthony Albert looks at how to gain a competitive advantage in credit risk management in the light…

Switching on CLS

As the continuous linked settlement initiative prepares for a delayed launch later this year, firms that have been involved since the beginning outline how they hope to recoup and build on their investments.

Banging the drum

Investor relations

ABB: a mixed outlook

Hold

New solutions

Cover story

Gaining an edge from Basel

Sponsored article

Russian intrigue

Gazprom

BBVA senior officials investigated

LOSS DATABASE

EU bank regulation debate intensifies

BASLE II UPDATE

UK central banker warns against half-baked contingency plans

DISASTER RECOVERY

Dealers debate regime change in US interest rate volatility

Has the US interest rate options market entered a new period of sustained higher implied volatility? Deutsche Bank says yes, but other leading dollar interest rate derivatives dealers say it is too early to tell. Mortgage investors and options writers…

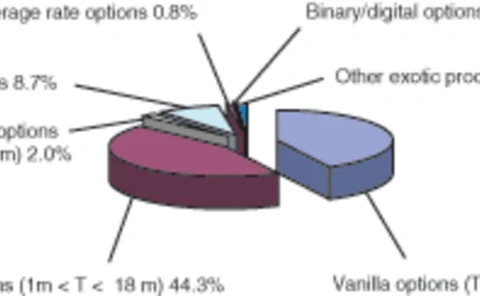

Fewer options in 2001 | A Risk survey

The foreign exchange options market cooled off significantly last year, as September 11 and lower forex volatility kept dealers away. Risk’s third annual survey of 13 large forex options houses reveals that their combined 2001 volumes fell by $1.1…