Central banks

Tools for the trade

Credit Risk

Banks bid for Roman risk management

Comune di Roma – the City of Rome – is close to awarding a mandate for the risk management of its €6 billion of outstanding debt, said bankers involved in a beauty parade city authorities have been holding over recent weeks.

Credit Lyonnais prepares Asian-flavoured arbitrage synthetic CDO

France’s Credit Lyonnais Securities is getting ready to launch a global arbitrage synthetic collateralised debt obligation (CDO) within a month, according to the bank’s head of Japan investment banking and ex-Japan Asian debt capital markets, Jean-Marc…

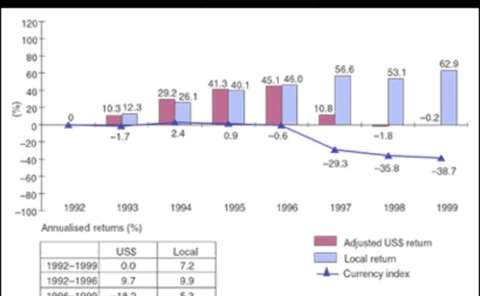

The roads to currency overlay

Forex risk

Higher or lower?

Credit Risk

Guarded optimism hinges on new tools

Catastrophe bonds

The risk transfer shell game

Credit derivatives

Corporate focus on credit risk management

Sponsor’s statement

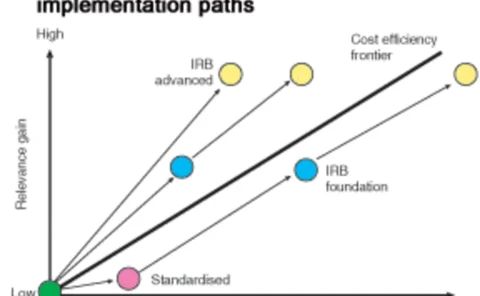

A cost/benefit approach to Basel II

The cost of implementing Basel II could put banks at a competitive disadvantage compared with non-banks, and spur them to ‘de-bank’ to avoid this regulatory burden. Harry Stordel and Andrew Cross say regulators must look at the provisions from a cost…

EU bank regulation debate intensifies

The debate over banking supervision in the European Union intensified in April as Britain and Germany argued for keeping regulation under the aegis of national regulators, while many central bankers argued that the role should be left to the European…

mmO 2

Credit of the month

Branching out

Credit derivatives

Asia's stock answer

Asian equity

Question time

Round table

Losses and lawsuits

LOSS DATABASE

Greenspan says Basle II could reduce extremes of business cycles

BASLE II UPDATE

A cost/benefit approach to Basel II

The cost of implementing Basel II could put banks at a competitive disadvantage compared with non-banks, and spur them to ‘de-bank’ to avoid this regulatory burden. Harry Stordel and Andrew Cross say regulators must look at the provisions from a cost…