Costas Mourselas

Follow Costas

Articles by Costas Mourselas

Coronavirus rout revives attacks on futures margining

FCMs call for permanently higher margins following “unprecedented” number of breaches

Oil price shock triggers big margin calls

Banks and exchanges worked through weekend in anticipation of oil collapse

A peek inside op risk managers’ coronavirus response

Op risk managers steel their firms for looming pandemic amid an expected rise in cyber attacks

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

CME, Eurex rebuff calls to compensate members for losses

BlackRock and BNP want CCPs that recover from a default to reimburse members and clients

EU banks rue SA-CCR mismatch with US

European clearers are stuck with CEM until 2021, but some US banks are reluctant to switch early

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Eurex members divided over liquidity risk charges

Banks say proposed charge too conservative, debate whether add-on should be charged directly to clients

OCC updates default auction rules to encourage buy-side bids

Clearer’s proposed changes follow client fears of being locked out

As business mix shifts, Eurex bulks up its default fund

Clearing house will raise charge to 9% from 7% as stress tests signal need for a fatter fund

On eve of Brexit, PPF’s chief risk officer isn’t too worried

Stephen Wilcox talks about getting pensions paid without the benefit of controlling ‘UK Plc’

JP Morgan turns to start-up to manage CME margin

Bank also weighing whether to bring its business at two other clearing houses on to Baton platform

Market participants question South African rate reform

Risk South Africa: Some urge caution as South Africa moves to reform Jibar

Robo-raters help banks vet vendors for cyber risk

Specialists tout service for monitoring third parties amid tougher rules on outsourcing risk

Frandt or foe? FCMs hit back at Esma buy-side clearing salvo

Esma pushes dealers to publish standardised fee schedules amid clearing capacity fears

Morgan Stanley, JP clear first cross-currency swap at Eurex

Two more banks onboarding; CCP hoping to extend service to clients in 2020

Fund fears linger over guidelines set to avert fire sales

Final Esma framework allays some European asset managers’ concerns

Ice, CME shore up clearing house recovery planning

Introduction of VMGH and tear-ups comes amid impasse over CCP recovery and resolution rules

Eurex to launch cross-currency swap clearing ‘within weeks’

Clearing service will target dealer-to-dealer trades before later rolling out to clients

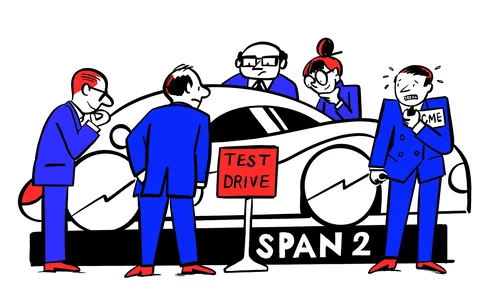

Span 2: a fine balance

Switching margin model means walking a tightrope of competing interests amid regulatory scrutiny

A look under the hood of Span 2, CME’s new margin engine

VAR-based framework has new ways of netting contracts and setting volatility floors and more

Clients demand access to CCP default auctions

“In a default, we are comfortable taking on risk and can move quickly,” says DRW’s Wilson

The great migration: CCPs ponder life after Span

As CME moves to a value-at-risk methodology, CCPs that license its model look on nervously