Nazneen Sherif

Follow Nazneen

Articles by Nazneen Sherif

Banks discount legacy swaps as ring-fencing looms

Expectation of higher funding costs post ring-fencing pushes UK banks to offload some trades faster

Totem extends pricing data to 10-year repos

IHS Markit service set to help banks with funding and swaps valuation concerns

Industry renews push for triBalance clearing exemption

Dealers using Emir review to request carve-out for optimisation trades

The bald truth about collateral haircut modelling

HSBC’s Wujiang Lou says parametric modelling of haircuts has many advantages over historical VAR

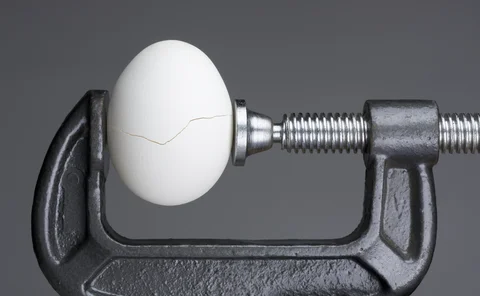

Compliance fears slow use of synthetic swaps to cut IM

Dealers want firmer guidance on whether technique to slash margin costs contravenes clearing mandate

Capital savings from new IM regime elude dealers

Slow model development and approval processes mean banks yet to see benefits expected under margin rules

Vega volumes triple on Vix spike

Rebalancing of Vix ETPs spurred record trading in Vix futures on August 10

Banks say Europe’s CVA proxy-spread plans lack flexibility

Dealers welcome EBA proposals but say limited number of eligible counterparties means few benefits

CCP stress testing gets real

Quants propose technique to generate effective, plausible CCP stress-testing scenarios

Complex short Vix products draw fire as vol plumbs lows

Hedging effects mean popular exchange-traded products vulnerable to big losses if volatility spikes

All MVA needs is a first-mover

Fair value adjustment for initial margin should be reflected in accounting statement

The price is still wrong: banks tackle bond CSA discounting

Diverging Eonia and European repo rates spur banks to look at valuations of swaps with bond collateral

LCH limits substitution to tackle quarterly collateral flight

CCP clamps down on bond-for-cash switches driven by reporting and quarter-end repo spikes

Banks turn to synthetic derivatives to cut initial margin

Options-based instruments can halve initial margin for some non-cleared products, say dealers

The untapped potential of stress tests

Quants propose technique to include stress testing in portfolio allocation

Time trial: the big risks that lurk in OTC margin gaps

Banks take aim at margin and trade-flow lag that can cause 95% of counterparty risk

Spectre of mass swap unwinds looms ahead of VM deadline

Dealers warn of market disruption if trades lacking new CSAs are terminated before September 1

Rethink urged over Basel’s counterparty exposure framework

Industry calls for softening of SA-CCR amid claims it could lead to doubling of calculated exposures

Time to talk about settlement risk

Quants are proposing netting or the use of CLS Bank to remove Herstatt risk in margined trades

EU capital revamp paves way for corporate CVA charge

Draft directive offers national regulators power to override controversial exemption

Dealers struggle with VM in non-netting jurisdictions

EU exemptions from margin posting are either hard to obtain or face client resistance

New execution algos show complexity is not to be feared

Quants develop method to include both market impact and limit orders in optimal trade execution

Some banks find huge margin savings by breaking up indexes

Splitting equity and commodity indexes can halve initial margin, but not everyone can do it

Academics warn against overuse of machine learning

Lack of data makes AI technology unsuitable for risk management, say Cont and Rebonato