Technical paper/Pricing

Dynamically controlled kernel estimation

An accurate data-driven and model-agnostic method to compute conditional expectations is presented

Optimal transport for model calibration

Volatility models and SPX/VIX joint dynamics are calibrated using optimal transport theory

Pricing American options under negative rates

This paper derives a new integral equation for American options under negative rates and shows how to solve this new equation through modifications to the modern and efficient algorithm of Andersen and Lake.

Risky caplet pricing with backward-looking rates

The Hull-White model for short rates is extended to include compounded rates and credit risk

A Darwinian theory of model risk

An ex ante methodology is proposed to analyse the model risk pattern for a broad class of structures

What is the volatility of an Asian option?

An adjustment for the volatility smile in Asian options is proposed

Solving final value problems with deep learning

Pricing vanilla and exotic options with a deep learning approach for PDEs

Differential machine learning: the shape of things to come

A derivative pricing approximation method using neural networks and AAD speeds up calculations

The econophysics of asset prices, returns and multiple expectations

The author models interactions between financial transactions and expectations and describe asset pricing and return disturbances.

A new arbitrage-free parametric volatility surface

A new arbitrage-free volatility surface with closed-form valuation and local volatility is introduced

Quantifying model performance

Quality of replicating portfolio is used to measure performance of a model

Two-factor Black-Karasinski pricing kernel

Analytic formulas for bond prices and forward rates are derived by expanding existing rate models

The SABR forward smile

Thomas Roos presents the expressions for the implied volatilities of European and forward starting options

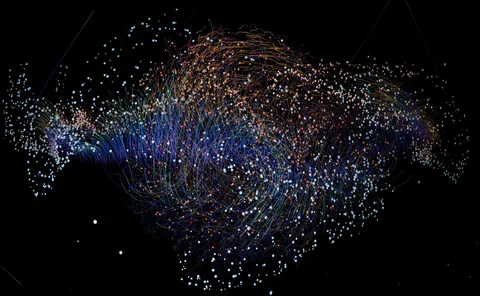

The impact of the cross-shareholding network on extreme price movements: evidence from China

By using information about the ownership structure of listed companies from 2004 to 2016, the authors construct the cross-shareholding network for each year and examine the effects of the network position of a firm on extreme price movement.

Cyber risk management: an actuarial point of view

This paper points out the peculiarities of cyber insurance contracts compared with the classical nonlife insurance contracts from both the insurer’s and the insured’s perspectives. The main actuarial principles that are fundamental to any valuation in a…

Path independence of exotic options and convergence of binomial approximations

In this paper, the authors analyse the convergence of tree methods for pricing barrier and lookback options.

A new nonlinear partial differential equation in finance and a method of its solution

In this paper, the author considers a special type of nonlinear PDE that arises by applying optimization to some financial problems.

Pricing and hedging options with rollover parameters

This paper consists of a “horse race” study comparing (i) a number of option pricing models, and (ii) roll-over estimation procedures.

Efficient pricing and super-replication of corridor variance swaps and related products

This paper proposes a method for overhedging weighted variance using only a finite number of maturities.