Reverse convertible

Playing the yield: rates rev up structured products

Higher government bond yields and steeper forward curves fuel demand for new range of fixed income structures

Interest rates house of the year: Societe Generale Corporate and Investment Banking

Multi-asset capabilities and risk recycling allow the bank to bring hit solutions to the market

Narrow range of index products stifles investor choice

Lack of liquid options on European mid-cap benchmarks leaves investors stuck with the blue chips

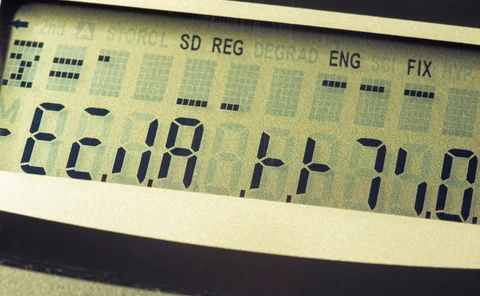

FVC review: Barclays issues reverse convertible on GoPro

Six-month product on volatile stock comes with an American-style barrier

FVC retrospective: UniCredit’s reverse convertible on Deutsche Bank stock matures

Product offered a fixed coupon of 4.75% and sizeable downside protection

Bank technology provider of the year: Societe Generale

Alpha SP platform has revolutionised product pricing, say distributors

FVC review: UBS offers short-dated reverse convertible on US stocks

Investors’ capital at risk if underlying is below barrier level at maturity

China rate cut boosts offshore structured product market

High-net-worth investors pile into dollar and commodity structures as PBoC loosens

How autocallable structured products came to dominate the retail market

Products still seen as easier sell than issuer-callables

Oil-linked structured products: investors take the plunge

Price drop and volatility spike drives interest in oil-linked structures

RCB reverse convertible offers safety at a cost

German investors get security with capped returns on Euro Stoxx 50

Single stocks versus indexes as an underlying asset

Allocation and better terms drive investors to single-stock underlyings

RBC reverse convertible taps 3D printing revolution

The next dimension

‘Complex’ definition eludes European regulators

Determining whether a structured product is "complex” – and therefore unsuitable for retail investors – continues to divide regulators in Europe

Barclays capital-at-risk pharma note pays 9.75% in the US

Coupons and capital risk

UBS reverse convertible breaches barrier as Research In Motion shares plummet

Disappointing harvest

Unicredit offers a low barrier and a 4.75% coupon on Deutsche Bank stock

Fixed coupon for the cautious

UBS reverse convertible short on tenor but high on volatility

Short and very sweet

Market snapshot: making the most of volatility

Market snapshot

Catley Lakeman – ‘keeping the banks honest’

Catley Lakeman acts as a go-between for banks and asset management companies looking to buy their structured products. Vita Millers talks to founding partner Russell Catley