Reinsurance

Rising systemic risk demands a new risk management paradigm

Reinsurers need insurance-linked securities to share burden of climate-related catastrophic risk

NAIC wants more disclosure about use of offshore reinsurance

US watchdog seeks improved data around deals some say allow insurers to game capital rules

US corporates tap euros for cheap debt and FX hedging

Interest rate differentials and cross-currency basis drive highest reverse Yankee issuance since Covid

Pricing and optimization of sidecar and collateralized reinsurance portfolios with stochastic programming

This papers investigates problems in pricing and optimizing sidecar and collateralized reinsurance portfolios, employing a stochastic programming approach to solve these problems.

NAIC proposes asset tests for offshore reinsurance

Cashflow assumptions that prove too aggressive could lead to follow-up action – Minnesota supervisor

Optimal time-consistent reinsurance and investment strategies for multiple dependent types of insurance business and a unified investment framework

This paper puts forward a novel insurance and illustrate the impact of model parameters on optimal investment strategies.

Financial firms rethink after cyber insurance premium spike

Brokers say there are signs pressure is easing, but quantum hacking threat could transform market

Pension buyouts: rock-bottom prices mask unease over risk

US insurers will digest $40bn in pension assets this year but tight pricing and an economic downturn could lead to reflux

Adapting to the new normal

The current interest rate environment and need to adapt to changing technology and regulatory mandates is keeping insurers on their toes, Nakul Nayyar, head of investment risk at Guardian Life, tells Risk.net

US Treasury urged to investigate private equity insurers

Senate banking committee chair says Athene and other PE-owned firms take more risk, may hold less capital

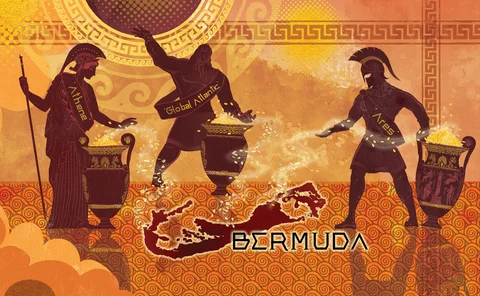

Apollo, KKR, Ares and the Bermudan CLO arbitrage

‘Capital efficiency’ may explain a 1,100% surge in life assets reinsured on the Atlantic island

Early deaths could kill defined benefit pension shortfalls

Covid-19 will only worsen a trend in life expectancy that was already well underway

Optimal reinsurance with expectile under the Vajda condition

In this paper, the author revisits optimal reinsurance problems by minimizing the adjusted value of the liability of an insurer, which encompasses a risk margin. The risk margin is determined by expectile.

Continued change and volatility impacting Solvency II reporting

The capital impacts of Covid-19 mean increased Solvency II monitoring and reporting challenges for insurers. This is occurring against a backdrop of continued regulatory change. Faced with the evolving challenges of Solvency II, Refinitiv highlights why…

Cat risk: why forecasting climate change is a disaster

Forecasters are poles apart on climate-driven catastrophes; insurers fear worse ahead

Navigating the impact of climate risk on financial stability

As uncertainty abounds on the impact climate change may have on the industry, financial services firms must best equip themselves for potential regulatory and socioeconomic changes to ensure they maximise the opportunities of embracing new best practices…

Munich Re's P&C capital charge swells €2bn in 2018

Property and casualty capital requirement pushes overall SCR to €14.7 billion

Munich Re adjusts sovereign portfolio

Reinsurer clips US, UK, Italy holdings

Brexit dims hopes for Solvency II change in UK

Lawyers say political tensions may have killed off chance of reform, following PRA U-turn

Solvency II capital charges concentrated in two key risks

Market risk SCR averages 37% across six large insurers