Quantitative finance

WHAT IS THIS? Quantitative finance is a field of applied mathematics concerned with financial markets. In banking, it spread from the pricing of derivatives to the modelling of credit, market and operational risks. Today’s quantitative analysts are scattered across a range of functions, from risk management and model validation, to data science, algorithmic trading and regulatory compliance.

Quants tout alternative carry trades for the ‘new normal’

Low rates and flatlining yield curves leave investors seeking carry in swaps and swaptions

Science friction: some tire of waiting for quantum’s leap

Use cases for new tech are piling up – from CVA to VAR. But so are the obstacles

Broken backtests leave quant researchers at a loss

As historical data loses relevance, quants must find new ways to validate their theories

Danske quants discover speedier way to crunch XVAs

Differential machine learning produces results “thousands of times faster and with similar accuracy”

Fund managers seek to plug holes in ESG data

Social intel proves elusive as virus reawakens sense of corporate virtue

For a post-Covid world, quant fund revives a contentious idea

Crisis puts out-of-vogue practice of “porting” alpha back in play

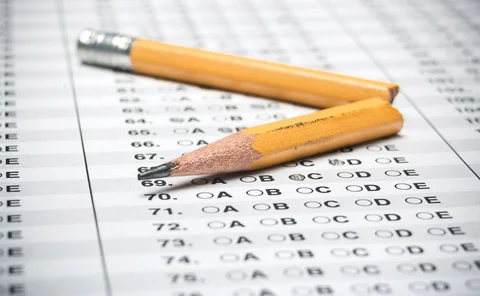

Quant finance courses tested by Covid’s echoing classrooms

Universities fret over drop in international students and demands of online learning

Optimal dynamic strategies on Gaussian returns

It is hoped that this paper will form a foundational approach to the study of dynamic strategies and how to optimize them. We make efforts to understand their properties without claiming to understand why they work (ie, why there are stable…

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

Podcast: Lipton and de Prado on Covid and trading strategies

Top quants discuss collaboration and their worries about the economic recovery

Bachelier – a strange new world for oil options

Model tuned to negative prices has implications for pricing, margining and delta hedging

Extreme volatility – Rising to the fair valuations challenge

Capital markets firms of all sizes continue to grapple with the challenge of developing fair valuations for the illiquid and hard-to-value securities they hold. While this scenario isn’t likely to be resolved anytime soon, there are specialist providers…

Two quants use options pricing tools to model Covid-19

New tool aims to gauge wider cost of virus control measures

Alt risk premia chasing 'tail beta' – again

Quant strategies that failed in the coronavirus crash face a reckoning

To model the real world, quants turn to synthetic data

Future financial models will be built using artificially generated data

The SABR forward smile

Thomas Roos presents the expressions for the implied volatilities of European and forward starting options

Managing a derivatives portfolio through turbulent markets

Steering a portfolio of non-linear derivatives, such as options and more exotic products, is challenging at the best of times. Market risks change as markets move and time passes, risks offset in complex ways and proxy hedging is common. In this feature,…

Quants pitch in to improve pandemic models

The finance industry’s quants are trying their hand at modelling the virus and its economic impact

Counterparty credit risk – Why data is only valuable in context

Paul Whitmore, global head of counterparty risk solutions at Fitch Solutions, explains how qualitative data can add colour and insight to quantitative metrics for assessing the creditworthiness of counterparty banks

Quants warn on credit risk in stocks

Conventional models may be missing explosion in novel exposure

Credit risk – Building on a foundation of quality data

Credit risk analysts at emerging market banks not only need high-quality data, but also the necessary tools to manage it. Improving consistency and reducing the risk of errors in credit risk data create more time to concentrate on the core activity of…

Covid transparency would soothe markets – Harvey

“Why aren’t our policy-makers sharing their models?” asks Duke University economist

Lighting up the black box: a must for investors?

Many contend you must be able to interpret machine learning in order to use it

‘Huge role’ for quants in Covid-19 response – MIT’s Lo

Policy-maker actions or missteps will drive markets, academic says