Optimal limit order execution

Crossed signals: row over collusion pits scholars against traders

An Oxford study claims to show evidence of collusion in ETF markets. Some traders give it short shrift

JP Morgan AM creates Taiwan trading hub

New local centre aims to channel orders in bulk, cutting price slippage

Buy-side quant of the year: Gordon Ritter

Risk Awards 2019: Quant uses new tech to tackle old problem of optimal execution

Trading lightly: cross-impact and optimal portfolio execution

A liquidity model for basket of correlated securities is presented

Optimal execution of accelerated share repurchase contracts with fixed notional

This paper studies the pricing and optimal execution strategy of an accelerated share repurchase contract with a fixed notional.

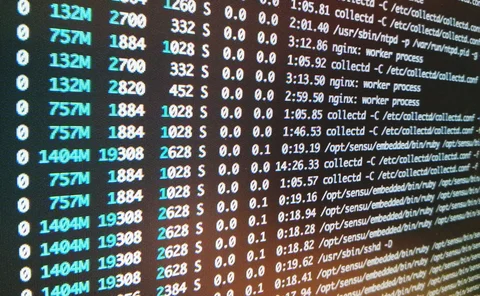

New execution algos show complexity is not to be feared

Quants develop method to include both market impact and limit orders in optimal trade execution

Fast and precautious: order controls for trade execution

Algo traders propose a new optimal execution algorithm with both limit and market orders

Optimal execution with a price limiter

Balancing the price uncertainty and price impact of large orders is an important issue for many market participants. While classical approaches lead to trading algorithms that are invariably price-path insensitive, in this article, Sebastian Jaimungal…