Operational risk

WHAT IS THIS? Operational risks are those arising from people, processes and systems – the biggest form of exposure for many industries, but one that was neglected by financial firms until the collapse of Barings Bank in 1995. It was added to the Basel capital framework in 2004, but attempts to model operational risk were dealt a heavy blow by the huge, unforeseen losses suffered by banks in the aftermath of the financial crisis.

Banks tout CCAR-style stress tests for emergent risks

Extreme-but-plausible scenario planning is being applied to geopolitical events such as Ukraine conflict

Archegos collapse raises red flags about risk management systems – and underscores need for investment in technology

This article reveals how the Archegos debacle exposed cracks in banks’ risk systems.

Op risk data: Allianz dealt a $4bn blow for not-so-Alpha Funds

Also: Credit Suisse cops two cartel shops; banks get slapped in gender pay gap. Data by ORX News

Banks: sanctions evasion driving rise in money laundering risk

Attempts by oligarchs to siphon cash out of Russia sparks heightened scrutiny of AML alerts

Goldman exec: rogue algos could spark ‘systemic’ crashes

Device proliferation and digital assets also altering risk environment, says Europe op risk head

Op risk outlook 2022: the legal perspective

Christoph Kurth, partner of the global financial institutions leadership team at Baker McKenzie, discusses the key themes emerging from Risk.net’s Top 10 op risks 2022 survey and how financial firms can better manage and mitigate the impact of…

Top 10 operational risks for 2022

The biggest op risks for the year ahead, as chosen by senior industry practitioners

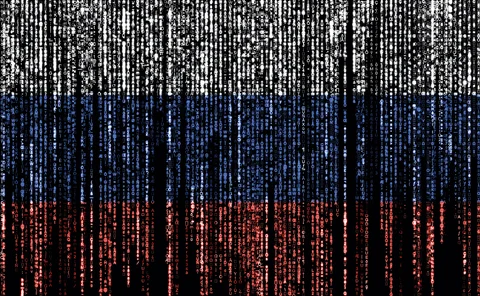

Top 10 op risks 2022: geopolitical risk takes centre stage

Ukraine invasion, western sanctions and Russian response seen driving big rise in cyber and supply chain risks

New technology is redefining the success of the front office

A Q&A with Numerix’s Chief Product Officer giving insights into how new technologies are changing the ways financial institutions operate, invest and trade

Russia sanctions put spotlight on banks’ dirty laundry

As punitive measures against Moscow increase, so do the risks to banks from financial crime

Europe’s banks brace for Russia-backed cyber retaliation

Beefed-up sanctions on Russia’s largest banks spark IT security alert; 100s of computers brought down in Ukraine

Banks hope new US rule will see AML judged on effectiveness

Proposed FinCEN ruling asks regulators to look beyond design to whether AML measures actually work

Preventing the unpleasant: fraudulent financial statement detection using financial ratios

In this paper, the authors investigate financial fraud in companies listed on the Athens Stock Exchange during the period 2008–18 and propose a model to detect fraudulent financial statements.

The Collins flaw: backstop turned binding constraint

US legislative tweak was meant to prevent banks from using their own capital models too liberally. It’s now something different

Revisiting the linkage between internal audit function characteristics and internal control quality

This paper revisits the linkage between internal audit function characteristics and internal control quality and proposes a random polynomial model for assessing ICQ.

Op risk data: Morgan Stanley, Capital One’s data breach double trouble

Also: Citi shells out $45m for misleading stock trading info; coding clangers cost Credit Suisse $9m. Data by ORX News

Digital transformation and the future of GRC

Covid-19 is forcing the pace of digital adoption in financial firms, placing new pressure on digital channels and processes

UBS sees $20bn RWA impact from Basel III

Increase expected to materialise by 2024 following the implementation of new rules on FRTB, CVA, credit and operational risk

Shell-company registry might not halt US dirty money, say experts

Observers raise questions over verifying beneficial owner info on proposed FinCEN database

Deutsche’s op RWAs down 10% in 2021

‘Bad bank’ unwinding pushed op risk at multi-year low

All top US banks below Collins floor

None of the eight systemic banks in the country above the threshold for the first time since 2015

Leveraging data in e-FX trading

A white paper explaining how, in a world where electronic trading has infiltrated virtually every aspect of today’s FX market, having access to data and the means to interpret it are fundamental components of a successful e-FX strategy