Model risk

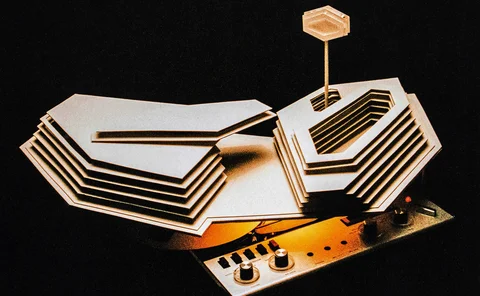

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why

The relative entropy of expectation and price

The replacement of risk-neutral pricing with entropic risk optimisation

XVA desks prioritise core tech upgrades over AI

Vendor upgrades, cloud-native rebuilds and sensitivities tooling dominate 2026 budget road maps

NMRF framework: does it satisfy the ‘use test’?

Non-modellable risk factors affect risk sensitivity and face practical and calibration difficulties, argue two risk experts

Almost two-thirds of banks now run XVAs on cloud

Risk Benchmarking study finds a majority of big dealers tapping cloud capacity, some exclusively, with others migrating

Lloyds draws a (second) line on AI risk

Model risk office is accountable for managing the risk of AI roll-out at the UK bank

How FCA could help tackle third-party risk in AI

UK regulator’s supercharged sandbox is designed to boost explainability and reduce reliance on vendors

When AI models malfunction, address the problem not the math

Governance of artificial intelligence models should focus on actionable outcomes rather than interpretability, argues former chief regulator

Multi-factor Gaussian model calibration: swaptions and constant maturity swap options

A novel closed-form method delivers a new way to calibrate interest rate models

Double VAR breach in Q2 adds $4.1bn to JP Morgan’s market RWAs

Sixth regulatory backtesting exception in nine months lifts the multiplier above minimum for the first time since Q3 2022

Generative AI brings testing times for modellers

Flagstar’s lead model validator offers some tips for safely integrating LLMs into risk models

The AI bot that left the garage

Senior operational risk exec explains how hidden third-party feature could lead to systemic risk

SEB’s market risk add-on swells 153% in Q2

Temporary adjustment more than doubles as internal model change awaits sign-off

US Fed urged to curb reliance on its own stress-test models

Original architect of DFAST says supervisors should stop putting all their eggs in one basket

Banks seek EU supervisory green light on external credit data

GCD-developed industry standard to show pooled loss data is representative of banks’ portfolios

Brain drain at OCC raises concerns about US model supervision

Quant team cull will reduce capacity to validate bank models, but that could be part of the plan

Model risk quantification for machine learning models in credit risk

This paper analyses bank-specific model risk measurement methods with a focus on implemented model risk rating solutions for MLMs and discusses challenges faced by the validation function.

Why AI-enhanced risk management is vital for open finance

In bank-fintech partnerships, AI can be both a source of operational risk and a solution to it

Citi close to launching GenAI investment tools

New tech will be used to improve investment recommendations and increase cross-selling

Amid tariff turmoil, banks warned not to fudge IFRS 9 overlays

Flip-flopping US policies challenge loan loss provisioning models; EU regulators take watching brief

Trading desks want regulators to face down the NMRF monster

Rule-makers in Australia and the European Union are open to changes to the unpopular FRTB test