Market risk

ECB seeks capital clarity on Spire repacks

Dealers split between counterparty credit risk and market risk frameworks for repack RWAs

Hong Kong derivatives regime could drive more offshore booking

Industry warns new capital requirements for securities firms are higher than other jurisdictions

The relative entropy of expectation and price

The replacement of risk-neutral pricing with entropic risk optimisation

Equity VAR hovering near four-year high at US banks

Gauges of stock market risk rise 36% in just one year

How Basel III endgame will reshape banks’ business mix

B3E will affect portfolio focus and client strategy, says capital risk strategist

US banks hoping for end of DFAST global market shock

As Fed consults on stress-test reform, lobby group argues regulator is double-counting market risk

SS&C Algorithmics: winner’s interview with Curt Burmeister

SS&C Algorithmics wins three categories in this year’s Markets Technology Awards in addition to Technology vendor of the year at the Risk Awards

NMRF framework: does it satisfy the ‘use test’?

Non-modellable risk factors affect risk sensitivity and face practical and calibration difficulties, argue two risk experts

The consequences of the Basel III requirements for the liquidity horizon and their implications for optimal trading strategy

The authors put forward a formula-based approach for determining the optimal liquidity horizon used in scaling the base expected shortfall under Basel III.

EU’s FRTB multiplier risks picking winners and losers

Attempts to find capital-neutral way to implement new rules might create unlevel playing field

LSEG adds market risk optimisation for FX options

Tool attracts eight dealers and could be expanded to rates and equity options

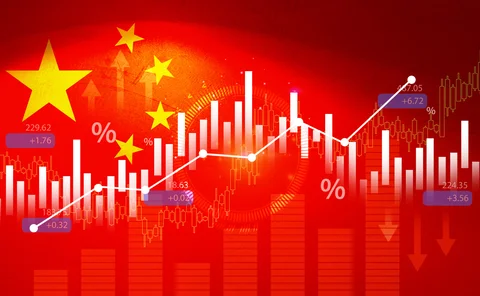

Market RWAs climb to new highs at top Chinese banks

Bank of China, China Construction Bank and Shanghai Pudong Development Bank set records for second successive quarter

Market-makers near limit for lira carry-based options trades

FX Markets Europe: Questions around liquidity, market risk and crowding constrain new Turkey flows

Default risk overtakes credit spreads in Japan's first year under FRTB

Securitisation charges lift a bigger slice of banks’ market risk requirements

BNP, Deutsche, SocGen face steep RWAs surge under FRTB SA

Pro forma disclosures for output floor show 2.5–2.8x increases if banks used only standardised formulas – far above peers

Has the Collins Amendment reached its endgame?

Scott Bessent wants to end the dual capital stack. How that would work in practice remains unclear

Basel III reforms expected to lift large bank capital requirements by 2.1%

Latest BCBS analysis highlights increased capital needs from the output floor

The curious case of the missing volatility risk premium

Volatility investors will need to work harder and smarter to capture value, says Capstone

EU banks’ incremental risk charges up 20% in H1 2025

Heightened trading flows and worsening credit outlooks leave dealers with more risk-heavy books

Basel III alone won’t be capital neutral, says Fed official

Endgame may raise requirements, but will be offset by changes to G-Sib and stress capital buffers

Basel III adoption gap widens as Turkey and India stall

With just a third of jurisdictions fully compliant, progress on the post-crisis banking reforms remains uneven worldwide