International

Gap risk fears push FX traders into Sunday-night Asia hours

Volumes surge at Singapore open as Trump’s weekend announcements force early risk management

Numerix strikes Hundsun deal as China pushes domestic tech

Homegrown tech initiative – ‘Xinchuang’ – a new challenge for foreign vendors

Amundi’s in-house expert keeping watch on Putin, Trump and Xi

Geopolitics expert Anna Rosenberg believes data and probability are key to forecasting market-moving events

‘This is not a wobble’: Brunello Rosa on the path to de-dollarisation

Digital currencies will play a central role as China challenges US hegemony, says economist

Acadian model detects gaps between climate goals and reality

Quant shop builds tool for net-zero alignment assessment, using NLP and Bayesian models

Bank of America’s Kris Fador elected FS-ISAC board chair

Industry consortium for cyber security also adds new board directors from Swift, PNC, Truist and CME

The impact of emerging risk on credit portfolio management

Bank credit portfolio managers are increasingly finding that non-financial risks, such as cyber risk and climate risk, are falling under the remit of credit portfolio management. This will also be impacted by the upcoming Basel III Final Reforms, which…

ING’s Russia loans sour five times faster than UniCredit’s

Risk density of Dutch bank’s Russia portfolio soars from 54% to 229% during 2022

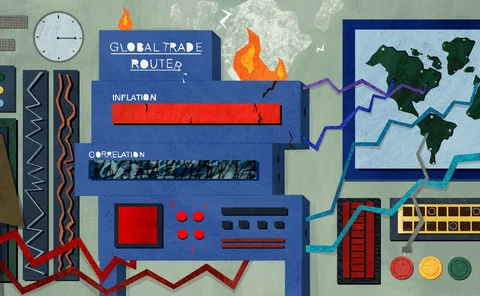

‘Globalisation rewired’: what does it mean for investors?

After half a century of outsourcing production to developing nations, companies are changing tack – with long-term implications for investors

EU and UK CCPs dominated by foreign members

Non-domestic clearing members accounted for over 70% of LCH’s and Eurex’s pool in Q3

FSB: third of climate stress tests not tackling physical risk

Six jurisdictions conducted exercises only for transition risk

What happens when a bank drops off the systemic risk radar?

Russia’s Sberbank skipped this year’s G-Sib assessment. But just because a bank is invisible doesn’t mean it no longer poses a risk

Global banks’ systemic footprint grew at record pace in 2021

Every indicator up on previous year, only the second time in G-Sib assessment history

Hong Kong, India, Turkey lag behind on Basel III framework

Only Canada, Japan and Saudi Arabia ready for full implementation as January deadline approaches

EU banks add overlays as crises evade modelling

Lenders buttress provisions against unpredictable fallout from Russia's invasion of Ukraine

Banks begin China close-out netting work after Isda opinion

Rise in collateralised transactions will be next step, dealers say

Russian corporates stashed cash at EU banks in Q1

Deposits from non-financial corporations increased 36%, while Moscow’s central bank cut balances by 28%

Japan’s GPIF divests $1.5bn in Russia-linked assets

Pension fund cut exposure to country by 95% in the 12 months to March

No soft landings in flight to safety from Russia

Impact of Ukraine invasion hit bank balance sheets hard; its effects look set to continue

Isda set to draft China netting opinion

Banks could be in a position to turn on close-out netting in China by third quarter

HSBC, StanChart face capital hit on cleared renminbi trades

Lack of UK recognition for Shanghai Clearing House could prompt banks to reduce exposures