Internal models approach (IMA)

Basel delay does not ensure global FRTB consistency

A European Parliament draft would let supervisors decide response to P&L attribution test fails

HKMA offers fast-track model vetting in swaps hub pitch

Streamlined process could take just six months, says official

The FRTB’s P&L attribution-based eligibility test: an alternative proposal

Spinaci, Benigno, Fraquelli and Montoro propose two alternatives to the P&L attribution test

Unlucky for some: Europe’s war on 13 Dutch prop traders

Liquidity hit feared as FlowTraders, IMC, Optiver and other non-banks face bank-style capital rules

Asian regulators need to step up to swaps challenge

Markets on the cusp of change require new supervisory capabilities

FRTB: Basel mulls capital relief for internal model desk fails

Market risk group member describes intermediate capital charge for desks that marginally fail the P&L attribution test

Volcker desks unlikely to meet FRTB requirements

Some trading activities will need to be reorganised to comply with market risk rules

ECB tells IMA banks to apply before rules are complete

Dealers criticise “unreasonable” timetable for FRTB model approvals, revealed in September call

FRTB: industry pushes to use own quotes in risk factor modelling

Isda working group proposes use of own quotes to minimise non-modellable risk factors

FRTB to create winners and losers on the buy side

Wider spreads could hit returns, but some funds eye opening in exotic and securitised markets

Adjusting to the P&L attribution test in FRTB

Consultants offer tips on eligibility framework for new internal models approach

Malaysia set to delay FRTB implementation

Local lenders wait on central bank’s interpretation of Basel standards before upgrading IT infrastructure

Prop traders rebuffed by FCA on capital modelling

Non-banks may have to use tougher market risk approach than bank competitors

P&L test in FRTB may not work – research

Delays in approval and small data sets may doom internal model approach, research finds

Seizing the opportunity of transformational change

Sponsored Q&A: CompatibL, Murex and Numerix

Fast and accurate KVA using AAD

Sponsored feature: CompatibL

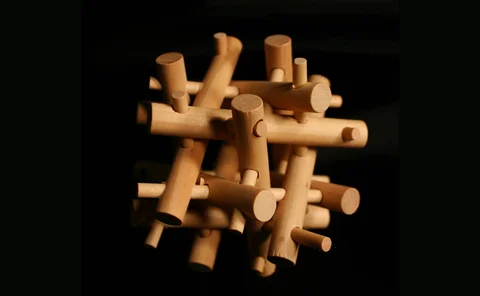

Solving the FRTB puzzle

Sponsored FRTB forum: IHS Markit

Basel takes flak over FRTB impact assessment

Market participants say capital hit has been underestimated

Inconsistent FRTB model guidance vexes dealers

Risk models pulled in opposite directions by P&L attribution test and non-modellable risk factors

FRTB: Basel guidance on backtesting frustrates dealers

Dealers blast “illogical” carve-outs for backtesting exceptions

Crowd trouble: the FRTB’s war on basis risk

FRTB will lead to build-up of risks around liquid benchmarks, dealers warn

FRTB will spark rise in basis risk, firms warned

Dealers using standardised approach may be incentivised to push clients towards less precise hedges

Basel IV – a timeline

How Basel's plans to tighten control over banks' internal models have evolved since 2014

Doom loop reloaded: CRR II goes soft on sovereign debt

EC dilution of Basel liquidity and market risk rules could create new regulatory arbitrage