Interest rates

The ‘get-out-of-debt’ card that may worry bond investors

A new paper analyses the controversial tool that governments may be forced to deploy to control borrowing costs

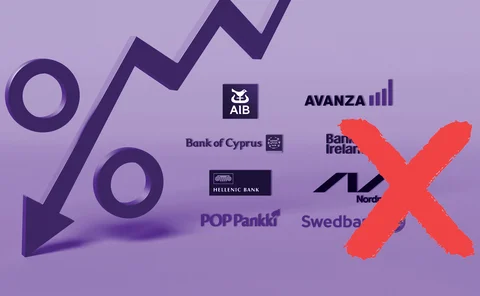

EU banks fear tumbling rates will upset their IRRBB balance

As rates decline, hedging two separate tests of vulnerability becomes more difficult

UBS sterling rates head joins RBC Capital Markets

Ian Hale joins the Canadian bank as head of European inflation trading

Political turmoil rattles Turkish lira carry trade

Echoes of March crackdown that sparked market rout leave traders on alert

Rates investors unmoved by stories of AI bliss, or doom

Research shows downward moves in US Treasury yields around generative AI model releases

Some European banks still failing net interest income test

Swedbank joins seven other outliers after it updates methodology assumptions

No progress on US banks’ EVE transparency in H1

Less than half of banks analysed disclose figures for key measure of long-term interest rate sensitivity

Sharper economic picture sets scene for dollar swaps rebound

Razor-thin bid/offer spreads and slim post-April trading volumes give way to an uptick in August

Brevan Howard: life beyond macro

Talking Heads 2025: Wider range of strategies helped firm rebound from 2018 low – but brought re-correlation risks

Barclays braces for a macro storm

Talking Heads 2025: Developed markets are racking up debt. Finding buyers could be difficult, says macro head Hossein Zaimi

BNPP, Deutsche among EU banks hit by VAR breaches in April

Sharpest rise in backtesting exceptions since 2022 Ukraine war shock largely linked to tariff chaos

JPM piles into Treasuries with record $72bn AFS surge

Portfolio reshaped with shift to medium-term maturities as Q2 glut boosts holdings to all-time high

As Fed meets, hedge funds buy ‘lottery’ FX options trades

Options bets reflect cautious pessimism over the dollar ahead of Jackson Hole conference

MUFG slashes JGB book by 27%

Second-quarter cuts lead to smallest AFS government bond portfolio since at least 2013

Fed’s new leverage ratio: the horse that never left the gate

Most of the biggest dealers aren’t leverage constrained now, and experts are sceptical that banks will use the extra capacity for Treasuries

Truist locks in $12bn long-term debt as rates hold high

Bank raises LTD and time deposits while slashing short-term borrowings

Barclays euro swap trading head departs

Ankur Aneja’s exit said to be unrelated to recent reports of job cuts

Investors hope US rate cuts will lower FX hedging costs

European investors in US assets set to boost hedge ratios as implied yields rise

Platforms expand portfolio trading to EGBs

Bloomberg and MTS to follow Tradeweb with extension of popular credit protocol

FMX set to extend trading hours for rates futures

New schedule matches CME’s hours, but some worry about clearing mismatch

High leverage in US REITs raises red flags, says FSB

Non-bank CRE investors at risk from falling prices and refinancing crunch

Simulation of Heston made simple

A new way to apply the classic stochastic volatility model is presented

Convexity adjustments à la Malliavin

This paper puts forward a novel means to approximate convexity adjustments in a general interest rate model using Malliavin calculcus.

Fixed income finesse: striking a balance amid shifting rates

An increasingly unpredictable economic environment leads investors to look for a wider range of products to satisfy evolving strategies