Hedging

Deep hedging: learning to remove the drift

Removing arbitrage opportunities from simulated data used for training makes deep hedging more robust

Derivatives exposures up 26% at BP

Oil giant posts fourth consecutive yearly increase in 2021

How do you solve a problem like the lira?

Asset managers diverge in their approach to managing Turkish currency turmoil as FX hedging costs soar

Shell derivatives exposure rose by $15bn in 2021

Over 93% of the oil giant’s derivatives instruments were designated as current

UK Treasury urged to allow failed energy firms to hedge

Bulb can’t buy wholesale electricity and gas more than two weeks in advance, leaving it exposed to price hikes

Fears over strong dollar put Asia’s hedgers on edge

Local corporates look to manage US dollar exposures in response to inflation and Fed tapering concerns

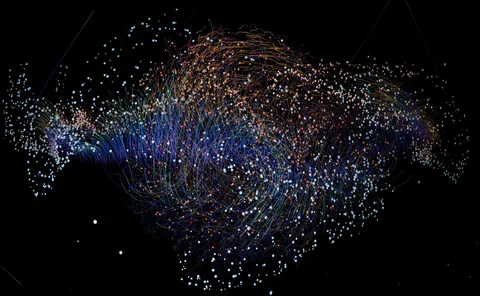

JP Morgan testing deep hedging of exotics

Neural network trained to hedge complex options using simulated data expected to go live this year

Dynamically controlled kernel estimation

An accurate data-driven and model-agnostic method to compute conditional expectations is presented

Euro/dollar crosses embrace RFRs, while other currencies lag

€STR becomes new standard for euro cross-currency swaps; CAD and AUD stick with legacy rates

Top 5 trends to watch in 2022

1. Individual investor initiative 2. ESG investing 3. Hedging China risk 4. Digitisation and cryptocurrency 5. Futurisation

Trends shaping investment in Asia

As several new trends impact investment in Asia, Randolf Roth and Mezhgan Qabool discuss how Eurex is catering to the evolving needs of market participants and what it sees happening next

Hedging specialists vie for swelling FX overlay business

Custodians, banks and others look to capitalise on trend for buy side to outsource currency hedging

Swaps between UK banks and foreign firms up in Q3

Despite latest uptick, gross value of derivatives contracts held by UK banks is 67% below 2008 peak

Investors question fixes for a quant strategy that’s stalled

Banks are revamping intraday trend strategies; buy-siders aren’t sure it’ll work

Bumpy ride expected as Libor reaches end of road

Heavy reliance on contractual fallbacks leaves market facing series of post-cessation risks

Loan markets call for clarity on scope of US Libor ban

Regulators must address “grey areas” in uncommitted facilities, urge participants

Demand for ESG structured notes spells hedging pain for banks

As products linked to niche equity indexes grow in popularity, banks grapple with vol risk they pose

Lack of quants dims chance of structured product boom in China

Quants in high demand as banks explore new products, and local rules call for onshore specialists

Blame to spare in UK energy supplier debacle

Price cap was part of the problem, but lack of hedging and oversight also contributed

Sales of China’s snowball notes fall

Issuers point to tighter equity index basis and recent regulator warning over marketing of snowballs

Losing their hedge: why so many UK energy suppliers went bust

Hedging strategies were powerless to protect firms from runaway energy price rises

Regulator says Covid has accelerated China’s reform agenda

CSRC vice-chair wants US firms to help develop onshore futures for risk management

Offshore hedging of foreign banks’ China claims at record low in Q2

Just 6% of claims on the country were hedged through offshore risk transfers at end-June, BIS data shows

Inflation swap stampede stirs fears of lopsided market

Soaring demand for inflation hedges leaves dealers struggling to balance exposure