Fragmentation

Uncertainty over ECB’s TPI muddies monetary and fiscal impact

Analysts say anti-fragmentation tool exposes long-standing flaws in EU fiscal framework

Esma warns new foreign clearing house rules could backfire

Löber says euro swaps trading may move away from CCPs that face toughest EU scrutiny

‘Nightmare’ of uncertainty plagues FRTB model applications

Shifting timetable and rule tweaks that could alter incentives dampen appetite for internal models

Credit risk capital models hanging by a thread in the US

Industry insiders expect Fed to drop IRB and IMM when adopting Basel III, but market risk models may survive

JPM: EU corporate CVA exemption could split swaps liquidity

Isda AGM: Market may price in permanent lower capital charge if exemption retained in CRR III

Optiver aims to gatecrash FX options private party

Dutch non-bank hopes to exploit shift to electronic markets in OTC options, following record $7bn trading day

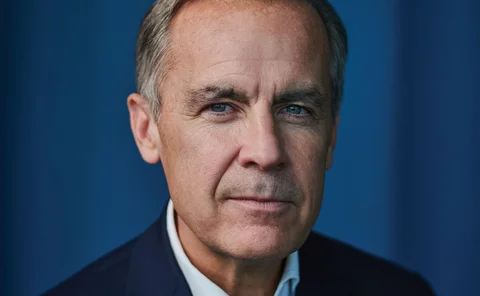

Lifetime achievement award: Mark Carney

Risk Awards 2022: The calm at the eye of the storm of post-crisis regulation and climate risk management

EU firms call for single consolidated tape provider

Some say new rules could create data fragmentation and raise connectivity costs

OTC trading platform of the year: Tradeweb

Asia Risk Awards 2021

Safety first: UK set to keep ring-fencing but may ease rules

There is also pressure to make changes to tackle banks’ overexposure to retail debt due to the rules

Fractured Libor transition halts US structured rates switch

Issuance of non-Libor caps and floors dries up as lending markets mull array of credit-sensitive SOFR rivals

The lonely Londoners: doubts plague UK quest for equivalence

Planned MoU won’t automatically bring equivalence, leaving firms in limbo for unknown duration

Why central banks aren’t worried about FX algos – for now

Disclosure failings feed into FX code; other issues are worrying, but distant, says SNB’s Maechler

Asia edging towards integrated capital markets – SGX’s Loh

Asia Risk 25: full regional co-operation could still be 10 to 15 years away, says Singapore exchange head

Revised FRTB deadline poses further challenges for Asia‑Pacific banks

Essan Soobratty, product manager for regulatory data, New York; Eugene Stern, global head of product, market risk, New York; and Vicky Cheng, head of government and regulatory affairs, Asia‑Pacific, Hong Kong, at Bloomberg explore the additional…

Libor Risk Q&A – KPMG

Chris Dias and Chris Long, principals and global Libor solution co-leads, discuss key industry concerns around the transition away from Libor, including how the discontinuation deadline will be impacted by the Covid‑19 pandemic, the benefits and…

The BoE leverage ratio: welcome relief or regulatory arbitrage?

UK banks are reaping higher capital savings through the BoE's leverage measure

Resented elsewhere, Mifid finds love at Esma

Huge cache of data helped Esma spot market abuse and inform policy, head of market data policy says

Q&A: Japan regulator aims to be glue for fragmented rules

“Unintended and unnecessary” splits in regulation damage financial markets, says FSA’s Ryozo Himino

Trading costs versus arrival price – An intuitive and comprehensive methodology

Craig Niven, managing director, cash equity execution at Societe Generale Prime Services explores how a five‑month study allowed the organisation to develop a market impact model using historical data, and why it is key for clients in the long term to…

Regulators rebuff fragmentation complaints

EC’s Guersent points to Fed hints that it would ease TLAC plans for foreign banks

FRTB: Nordic banks mull regional data pool

Local tie-up could “prevent big banks entering the markets in the Nordics”, says local risk manager

BoE to authorise EU CCPs ‘at 00:01’ on Brexit day

Central bank hopes plan to preserve access for EU CCPs will be reciprocated

Basel rules risk fragmentation after key compromise

Basel Committee ready to release new accord but patchy adoption of internal model floor and FRTB expected