Equities

Exchange-traded product volumes up 13% in 2010

Fixed-income exchange-traded products made money, investors turned to gold and a decline in assets followed falls in the equity markets in the first half of this year

HSBC survey: Hong Kong individuals most affluent in Asia

Hong Kong affluent individuals hold average liquid assets of $301,289, almost double Singapore’s at $183,145 and Taiwan’s at $155,162.

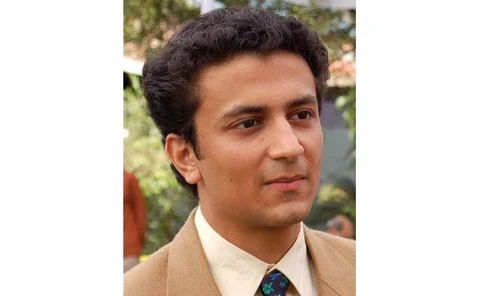

Joshi joins Deutsche Bank as head of Emea Equities

After leaving Barclays Capital last Friday, Dixit Joshi, formerly head of equities for Emea and Asia-Pacific at the UK bank has joined Deutsche Bank in a similar role

Skandia offers the insurance route

Global savings and insurance heavyweight, Skandia, has been distributing structured products in Sweden since 2005 when it launched two products with Skandiabanken as issuer. Since then the Swedish branch has gone on to use various other intermediaries…

Economists fear 'global bond trap'

Economists warn fiscal belt-tightening in Europe may exacerbate imbalances in the global economy, leading to sluggish growth and excess liquidity in government bonds.

Vanguard creates ETFs on equities, fixed income and property

Vanguard has increased its US ETF offering with the addition of a host of new products based on the benchmark S&P 500 and Russell 2000, and including equities, fixed income and property

Liquidnet debuts offshore alternative trading in New Zealand

New Zealand is poised to have what is believed to be its first offshore dark pool when Liquidnet launches its trading operation on June 22.

IAS 19 to speed pension de-risking

Proposed changes to accounting standards will remove some of the reporting freedom enjoyed by pension funds and could steer them away from investing in equities towards the relative safety of bonds and swaps – a development that could have an impact on…

In transition

Transition management is gaining popularity in Australia, with longer transitions using off-exchange trading platforms becoming increasingly common. But there are plenty of risks associated with such trades. Rachel Alembakis reports

Constructing a reputation

China Construction Bank (Asia) is enhancing its retail offerings in Hong Kong ahead of a planned expansion into mainland China. But the distributor is delaying sales of accumulators to high-net-worth and private banking clients for fear of reputational…

Sponsored statement: Standard Chartered – winning for clients in Asia, Africa and the Middle East

Standard Chartered delivered an impressive set of results for 2009 even as its competitors across the world continued to suffer the fallout of the financial crisis. Group head of financial markets, Lenny Feder, talks about the successes of the year and…

Banca Fideuram focuses on clarity

Tightening spreads are making it more difficult for banks to factor protection into their products and although the market is stabilising, having protection and products they understand is still an important factor for Banca Fideuram’s customers. Clare…

Fund managers becoming bullish on hedge funds

Fund managers have largely bullish views on hedge fund investments over the next five years in a sign that confidence is returning to the market.

WisdomTree bears fruit

WisdomTree has made its name by offering alternatives to the standard ETF fare, with a suite focused on efficient weighting, access trades and active management. Now it is poised for yet more growth, and expects to start capturing assets previously…

Wrestling with correlation

The correlation risk inherent in most structured products represents an ongoing headache for manufacturers. While new regulatory proposals would affect how much risk banks keep on their books, market dynamics are at play, especially the rise in…

India finds some forward momentum

The global financial crisis could easily have sounded the death knell for India’s nascent structured products market. But as the country’s equity markets have resumed their upward trend, dealers say equity-linked structures are catching on fast.