Emissions

Rabobank’s shaky loans up 35% on emissions cut plans

Bank says Dutch government proposal to reduce pollution from livestock farming risks making loans unviable

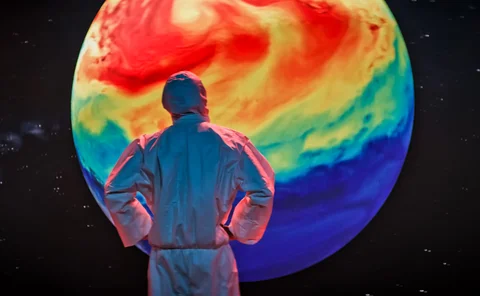

LGIM’s climate modelling shows ‘point of no return’ in 2025

Cost of limiting global warming to 1.5°C will become too great for economy within 36 months

LGIM blasts ‘dangerous’ netting of short positions on carbon emitters

Netting shorts on big polluters distracts investors from task of persuading firms to slow climate change

Carbon fund increases returns by decreasing supply of permits

Europe’s emissions trading system could be a catalyst for the energy transition, but only if prices rise

Single climate risk metric ‘not realistic’, says Bank of England

Senior official argues banks and investors must weigh up multiple factors when assessing climate risk

Net zero banks playing catch-up in ECB climate review

Banks that aim to align to Paris Agreement still fall short on climate disclosures

Bitcoin’s carbon footprint rises with prices – DNB research

Total carbon emissions produced by crypto assets rose by 25% in 2020, study finds

BlackRock’s 65% of AUM accounts for 1% of global emissions

Asset manager’s absolute emissions linked to corporate securities and real estate stood at 330.7 million tons of CO2e in 2020

SMFG reports highest power sector emissions intensity

Across all systemic banks, only eight dealers disclose their GHG emissions for this field

Climate risk takes scenario analysis and stress-testing to the next level

Financial institutions are facing several challenges as they prepare for the transition risk journey that will see them evaluating their existing risk and finance solutions. Ludwig Dickens, client advisor, risk business consulting, at SAS discusses what…

Systemic banks: black boxes on green issues

Less talk and more action needed around climate disclosures linked to carbon emissions

Most G-Sibs fail to disclose financed emissions

None of the world’s top 30 banks disclose climate impact of their whole portfolio

EU’s new carbon-scoring metric bedevils investors

Buy-side risk survey 2021: Evic could have harmful consequences for green investing

BlackRock’s own reporting undermines its climate claims

Axa, Allianz and Legal & General have all cut their investments’ emissions, unlike BlackRock

TCFD backs carbon disclosure, but not temperature scores

Influential standard setter decides the implied temperature rise ‘is not ready’ for funds

Amundi, Axa urge boardroom pay cuts for climate laggards

Link remuneration to carbon-emission goals and companies will get serious, say large investors

The sticky question of Europe’s oil-ridden ESG funds

NN Investment Partners SFDR fund holds 91% of investments in oil and gas companies

Addressing competitiveness of emissions-intensive and trade-exposed sectors: a review of Alberta's carbon pricing system

This paper assesses mechanisms used under the CCIR to address competitiveness-driven carbon leakage for emissions-intensive and trade-exposed sectors with a focus on Alberta’s oil and gas industry.

BlackRock faces an early climate change test in China

The firm is the main Western investor in three of the worst emitters. It has yet to change their ways

Energy Risk Commodity Rankings: firms provide a lifeline in choppy waters

Winners of the 2021 Energy Risk Commodity Rankings supported clients in unprecedented times to be voted counterparties of choice

BNP Paribas AM turns to machine learning for carbon emissions

AI may help fund manager count emissions that companies fail to report

New Hong Kong fund rules collide with China’s poor ESG data

Under proposed rules, funds will need climate risk data from investee firms, many of them Chinese

No short answer: hedge funds hesitate on Europe’s ESG rules

SFDR sustainability calculations leave firms uncertain how short positions should be disclosed

Funds breathe out as EU regulators ease ESG data rules

Majority of mandatory indicators become optional in final draft of sustainability regulation