Derivatives

Two-thirds of ETRM users plan new systems in 2010

Some 67% of respondents to Energy Risk’s 2010 Software Survey say they will be investing in new energy trading risk management (ETRM) systems this year, to tackle dissatisfaction with the speed and usability of existing software systems, as well as…

Regulators take aim at unrealised derivatives profits

Accounting changes promoting more fair-value reporting are forcing supervisors to consider radical restrictions on the way banks use profits.

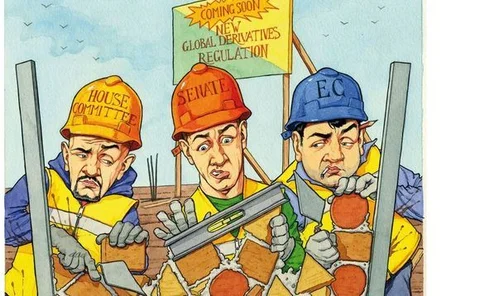

To be clear on OTC regulation

The US House of Representatives passed a bill on December 11 requiring all standardised derivatives contracts traded between dealers and major swap participants to clear through a registered clearing organisation. The Senate is preparing to debate its…

Clearing up

Roger Liddell, chief executive of LCH.Clearnet, talks to Alexander Campbell

In search of the perfect match

Demand from pension funds for structured products has slumped during the financial crisis due to the great sell-off of equity risk. But the downturn has raised awareness of how derivatives can help match assets and liabilities, a strategy that is on the…

The Thais that bind

The Bank of Thailand relaxed its regulations covering the use of derivatives towards the end of 2009. While retail investors are already allowed to buy structured notes and deposits linked to some foreign variables, the relaxation of rules has provided…

OTC reforms built to last?

Reform of derivatives markets is gathering pace in the US ahead of a crucial debate in the House of Representatives. But questions remain over exemptions for corporate hedgers and foreign exchange swaps and forwards, meaning the final architecture of the…