Credit risk

Enhancing counterparty credit risk management in modern banking

A webinar addressing banks' strategies for optimising credit risk mitigation strategies and utilising risk-sensitive margining to manage counterparty exposures effectively

Banks look to offload ‘orphan’ hedge risk

Bespoke CDSs shift private credit borrowers’ derivatives default exposures back to the buy side

Capital rules explain leverage craving in US bank risk transfers

Tougher requirements have led to conservative structuring and lower coupons

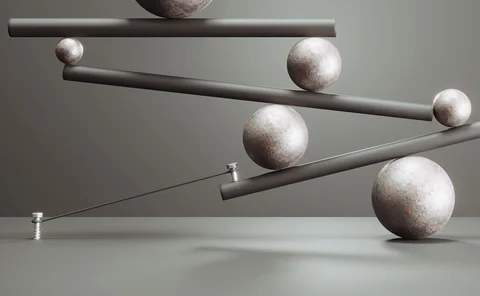

Weighting for leverage

A credit exposure model for leveraged collateralised counterparties is presented

Credit risk management solutions 2024: market update and vendor landscape

A Chartis report outlining the view of the market and vendor landscape for credit risk management solutions in the trading and banking books

New CDS index delayed by regulatory capital concerns

Dealer worries about impact of self-referencing trades derail CDX Financials launch at last minute

China CDS users slow to embrace new credit event panel

Decisions from Nafmii determinations committee yet to be switched on in agreements

Japanese banks far apart on credit model efficiency under Basel III

MUFG lowered credit and CCR charges the most among country’s top dealers

New real estate model adds €14bn to Rabobank RWAs

CET1 ratio down 1.2pp as capital stays flat

US large bank CRE risks could be understated, say researchers

Community banks have the most direct exposure, but systemic banks extend more credit to REITs

Record number of US banks turned to riskless assets in Q1

Western Alliance leads pack with doubling of exposures in 0% bucket

ABN Amro takes €1.7bn RWA add-on from credit models rejig

Just over 40% of credit risk RWAs still calculated under the A-IRB approach, down from 90% two years ago

Key indicators for the credit risk evaluation of clients and their changing characteristics

The authors propose a credit risk evaluation model for energy performance contracting projects with debt- paying ability and long-term capital debt ratio as optimal indicators.

Chicago Fed research points to systemic risk from private credit

Life insurers that have tripled exposures could face a liquidity squeeze, say economists

Fed green lights more capital relief trades

Five US banks authorised to issue repeat credit-linked notes backed by financial guarantees

Tracing credit contagion effects from corporates to the real estate sector

S&P Global Market Intelligence explores possible credit contagion effects from the corporate sector to real estate by using S&P Global Ratings’ research and underlying data to formulate clients’ own views on risks in the sector

Napier Park to increase investment in bank risk transfers

Hedge fund sees secular trend in lenders offloading credit risk, and plans to be part of it

ANZ’s end-period VAR spikes to highest in a decade

Interest rate risk drives 53% surge; market risk up A$1.6bn

Six Chinese banks set market risk records in Q1

Market RWAs spike 63% overall in first disclosures after rules update

How Man Group’s private credit arm keeps risk in check

Mid-market lending no place for weak covenants, flexible addbacks or payments in kind, says Varagon CEO

For a growing number of banks, synthetics are the real deal

More lenders want to use SRTs to offload credit risk, but old hands say they have a long road ahead

One-tenth of US banks exceed CRE concentration thresholds

US supervisors face operational challenge with constellation of 536 lenders above risk benchmarks at end-2023

Risk, portfolio margin, regulation: regtech to the rescue

This Whitepaper addresses the complexity of today’s risk environment for market professionals which can only be fully met with a regtec approach. Cost, competition, technology capability, and regulation influence and drive decision making.

Financial distress prediction with optimal decision trees based on the optimal sampling probability

The authors propose and validate a tree-based ensemble model for financial distress prediction which is demonstrated to outperform comparative models.