Collateralised loan obligations

Why CLO managers are agreeing to extend and amend

“There is no downside” to extending maturities, say CLO manager and investors

Loan-heavy borrowers may spell trouble for investors

US high-yield borrowers that relied wholly on loans are now vulnerable to rising rates

CLO managers snapping up discounted high-yield bonds

Holdings in European CLOs top 8% as managers push to increase caps on fixed-rate assets

CLO equity investors stung by Libor basis

Growing mismatch between one- and three-month tenors slashes payouts by a third

Sluggish SOFR lending keeps CLO basis contained

Slow credit markets keep risk in check for CLO equity holders

Risk applications and the cloud: driving better value and performance from key risk management architecture

Today's financial services organisations are increasingly looking to move their financial risk management applications to the cloud. But, according to a recent survey by Risk.net and SS&C Algorithmics, many risk professionals believe there is room for…

Rival platforms battle to control electronic trading of CLOs

Octaura has the backing of dealers, while Kopentech is leaning into its buy-side roots

Staying ahead of financial crime: powered by the cloud

A webinar exploring how to safeguard your institution and customers from financial crime with the speed and agility of the cloud

Varying responses from defined benefit pension schemes as TCFD requirements come into force

Zoi Fletcher speaks to Simon Robinson, director of product management at Moody’s Analytics, about how the industry and DB pension schemes are responding to the TCFD recommendations

Op risk data: Allianz dealt a $4bn blow for not-so-Alpha Funds

Also: Credit Suisse cops two cartel shops; banks get slapped in gender pay gap. Data by ORX News

US Treasury urged to investigate private equity insurers

Senate banking committee chair says Athene and other PE-owned firms take more risk, may hold less capital

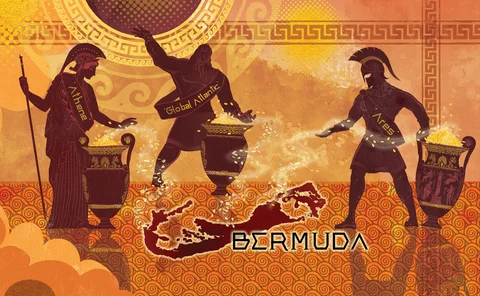

Apollo, KKR, Ares and the Bermudan CLO arbitrage

‘Capital efficiency’ may explain a 1,100% surge in life assets reinsured on the Atlantic island

Emerging trends in op risk

Karen Man, partner and member of the global financial institutions leadership team at Baker McKenzie, discusses emerging op risks in the wake of the Covid‑19 pandemic, a rise in cyber attacks, concerns around conduct and culture, and the complexities of…

How PGGM made 11% a year selling credit protection to banks

Dutch investor expects returns to drop over time unless rising inflation widens risk premia

Libor countdown clinic #2

There is still a lot to do ahead of the Libor cessation deadline, and predicting the story’s closing chapter is not easy. This webinar explores what is left to prepare, who’s ahead, what they’ve done and how they’ve done it.

Assessing climate risk in bond portfolios

Running climate stress tests on bond portfolios is a nascent exercise for many asset managers. MSCI looks at what to consider when optimising bond portfolios for climate exposures

The impact of European gas prices on climate goals

As governments increase their focus on climate change following the UN Climate Change Conference, COP26, ZE Power asks whether high gas prices in Europe could derail decarbonisation efforts

Building resilience into ESG risk management

Risk and resilience continue to play an important role in the navigation of an increasingly uncertain world. Fusion Risk Management explores why it is equally crucial for technology to support organisations in addressing pertinent environmental, social…

Moving from risk to resilience: making your organisation anti-fragile

Moving from basic risk management to real resilience is a critical capability organisations must strive to attain. Teams are seeking to quickly mature resilience as businesses, countries and economies reopen (and, in some cases, close again) in the wake…

Data-driven execution: looking back to see forward

Reviewing favourable outcomes and attempting to replicate them is by no means a new concept across the capital markets. Portfolio managers, execution professionals and risk managers use this principle to drive their decisions, although it is really only…

Measuring climate risk: what’s possible now

Governmental and societal pressure on banks and asset managers to help manage climate risk and disclose progress toward a sustainable future is high. Institutions are working to quantify the impact of climate change on their balance sheets and want to…

Helping firms make the most informed business decisions

Stephane Rio, founder and CEO of Opensee, discusses the extent of the data challenges facing all capital markets firms

Next-generation ESG derivatives

Amid increasing concern for the future of the planet, the demand for environmental, social and governance (ESG) factors has grown significantly. As such, global investors are looking for tools to support the development of sustainable portfolios. ESG…

How Athora uses its ties to Apollo to boost returns

European life insurer boosts returns by sourcing loan assets directly from private equity firm