Asset and liability management (ALM)

Sponsored statement: Royal Bank of Scotland

Liquidity – a new asset class? New opportunities for insurance and pension funds

Planning for bankruptcy of a major counterparty

Backup plan

Central Europe - insurers look to overcome region's ALM challenges

Taking the centre ground

Pension fund risk manager of the year: Pension Protection Fund

Risk awards 2011

Corporate risk manager of the year: BMW

Risk awards 2011

Banks moving to build liquidity ahead of Basel III

Building up buffers

Asia Risk Congress 2010: ING risk head admits mispricing variable annuities

Industry has underpriced variable annuities, conference hears

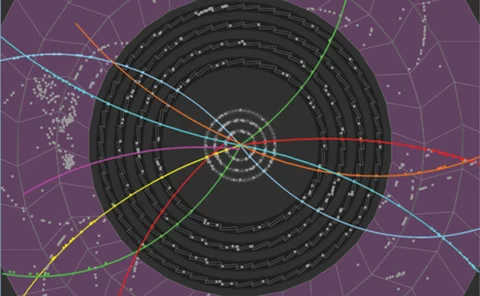

Cern pension fund – moving beyond LDI

Frontiers of funding

Vote in the 2010 Risk magazine technology rankings

Vote for the top vendor in a variety of risk management and derivatives trading technology categories.

Basel Committee sovereign debt plans criticised

Basel Committee’s proposal to increase bank liquidity through sovereign bonds could hinder efforts to meet capital ratio targets, conference hears

Limited upside for consumer non-cyclicals: LGIMA's John Bender

To the best of their liability: LGIMA profile

Asia Risk 15: Mastering mismatches by using ALM risk tools

The development of domestic bond markets and longer-dated hedging instruments in Asia during the past 15 years has helped insurers to manage their duration mismatches. But there is still a long way to go. By William Rhode*

IAS 19 to speed pension de-risking

Proposed changes to accounting standards will remove some of the reporting freedom enjoyed by pension funds and could steer them away from investing in equities towards the relative safety of bonds and swaps – a development that could have an impact on…

Deutsche Bank boosts bond origination team

Reid Payne, Maryam Khosrowshahi and Anatoli Kossarik join Deutsche Bank’s CEEMEA debt capital markets team.

Reversal of fortune

Inverted swap spreads have defied earlier predictions that they were a short-term aberration to still be a feature 18 months after their first appearance. Is this set to continue and, if so, does it pose an opportunity for pension schemes and insurers?…

Sponsored statement: Standard Chartered – winning for clients in Asia, Africa and the Middle East

Standard Chartered delivered an impressive set of results for 2009 even as its competitors across the world continued to suffer the fallout of the financial crisis. Group head of financial markets, Lenny Feder, talks about the successes of the year and…

Risk Espana rankings 2010

Changing of the guard

Negative carry presents corporate hedging conundrum

Steep interest rate yield curves cause corporate treasurers to focus on the cost of carry.

In search of the perfect match

Demand from pension funds for structured products has slumped during the financial crisis due to the great sell-off of equity risk. But the downturn has raised awareness of how derivatives can help match assets and liabilities, a strategy that is on the…

Variable annuities: waiting for the next generation

A few years ago European insurers were issuing increasing numbers of guaranteed products that resembled structured notes. What scope is there for this type of business today? By John Ferry

Replicating success

The financial crisis drummed home to many banks the advantages of quickly calculating exposures and executing hedges for complex portfolios. As a result, some banks are looking to the insurance sector and their use of replicating portfolios. By Clive…