Asset and liability management (ALM)

Many banks see obstacles to options-based IRRBB hedging

Liquidity, accounting treatment and culture seen as impediments to wider use of swaptions, caps and floors

Third of banks run ALM with five or fewer staff

Across 46 firms, asset-liability management is usually housed in treasury, but formal remits and staffing allocations differ sharply

Credit spread risk: the cryptic peril on bank balance sheets

Some bankers fear EU regulatory push on CSRBB has done little to improve risk management

Credit spread risk approach differs among EU banks, survey finds

KPMG survey of more than 90 banks reveals disagreement on how to treat liabilities and loans

One in five banks targets a 30-day liquidity survival horizon

ALM Benchmarking research finds wide divergence in liquidity risk appetites, even among large lenders

Bank ALM tech still dominated by manual workflows

Batch processing and Excel files still pervade, with only one in four lenders planning tech upgrades

Many banks ignore spectre of SVB in liquidity stress tests

In ALM Benchmarking exercise, majority of banks have no internal tests focusing on stress horizons of less than 30 days

ALM Benchmarking: explore the data

View interactive charts from Risk.net’s 46-bank study, covering ALM governance, balance-sheet strategy, stress-testing, technology and regulation

Staff, survival days, models – where banks split on ALM

Liquidity and rate risks are as old as banking; but the 46 banks in our benchmarking study have different ways to manage them

Buy-side ALM product of the year: Ortec Finance

Ortec Finance wins Buy-side ALM product of the year at the Markets Technology Awards 2026 thanks to its stochastic modelling platform, GLASS

EBA to weigh in on credit spread risk conundrum

Industry confusion persists over which products in banking book are affected by spread changes

ECB finds holes in banks’ credit spread risk nets

Banks censured for insufficient evidence to support exclusion of products from CSRBB perimeter

The future of ALM: the rise of risk-adjusted business planning

Where financial institutions can build a foundation for risk-adjusted business planning, aided by the ALM systems of the future

Why banks don’t believe each other’s IRRBB models

Regulatory outlier test results prompt mutual suspicion of unrealistic deposit assumptions

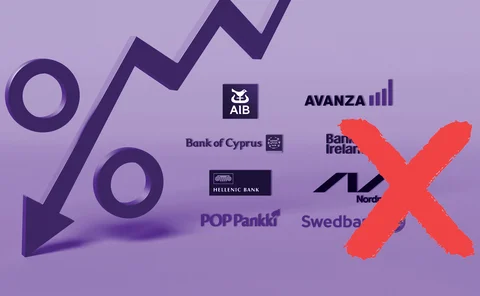

EU banks fear tumbling rates will upset their IRRBB balance

As rates decline, hedging two separate tests of vulnerability becomes more difficult

Some European banks still failing net interest income test

Swedbank joins seven other outliers after it updates methodology assumptions

Was a big US bank close to collapse in 2023?

PNC’s Bill Demchak says it was. And the data suggests he was talking about BofA

What is driving the ALM resurgence? Key differentiators and core analytics

The drivers and characteristics of a modern ALM framework or platform

Bank ALM system of the year: Prometeia

Reflecting the strength of Prometeia’s ALM platform and the firm’s alignment with the needs of modern risk and performance management

First Citizens used AI to retain SVB customers

Retention effort involved using AI to monitor customer behaviour and sentiment – including profanities

Built for stress: rethinking liquidity management in a new era of risk

Funding liquidity strategies must evolve to thrive in a climate defined by volatility, regulatory pressure and rising depositor stress