Asset allocation

A primer on generalized weighted risk functionals

The authors put forward a class of generalized weighted risk functionals that incorporates the possibility of arbitrary aggregations, introducing the notion of an aggregation function in the context of the aforementioned weighted risk functionals.

Allocators try to stay strategic in a world turned upside down

Investors are revisiting long-held assumptions about how to allocate large pools of assets

Investors find smoother path with smart beta

In the face of evolving volatility, investors are demanding a smarter approach to strategic asset allocation

Why asset owners aren’t turning their backs on America (yet)

Pension and sovereign wealth investors see US exceptionalism outlasting policy-driven turmoil

Podcast: Alexandre Antonov turns down the noise in Markowitz

Adia quant explains how to apply hierarchical risk parity to a minimum-variance portfolio

Man Group airs climate allocation tool for real-world decarbonisation

Compass is a guide for steering $200 trillion investment toward decarbonising high-emission industries

The (slow) road to capital-backed investing for pensions

Partnerships with hedge funds and private equity firms promise a quicker route to funded status. So why have deals stalled?

Peak-to-valley drawdowns: insights into extreme path-dependent market risk

The authors investigate risk in relation to peak-to-valley market drawdowns and aim to gain insights into the drawdown behaviour of asset classes across time intervals.

Optimal allocation to cryptocurrencies in diversified portfolios

Asset allocation methods assign positive weights to cryptos in diversified portfolios

Podcast: Artur Sepp on rates volatility and decentralised finance

Quant says high volatility requires pricing and risk management models to be revisited

Target-date funds: lessons learned?

The authors return to the topic of their 2011 paper and investigate the maturation of target-date funds and their performance during the Covid-19 pandemic, finding that the funds have largely achieved their designation.

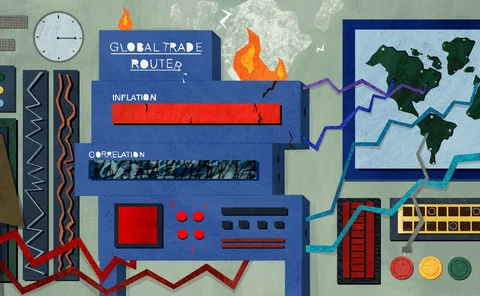

‘Globalisation rewired’: what does it mean for investors?

After half a century of outsourcing production to developing nations, companies are changing tack – with long-term implications for investors

Podcast: Halperin on reinforcement learning and option pricing

Fidelity quants working on machine learning techniques to optimise investment strategies

Asset allocation with inverse reinforcement learning

Using reinforcement learning to help replicate asset managers' allocation strategy

Illiquid assets throw UK pensions off balance

Collapse in equity and bond prices leaves some funds with outsized exposure to private holdings

UMR and the growth of client clearing

Following the implementation of phase six of the uncleared margin rules (UMR) this September, buy-side firms in-scope are carefully considering how to allocate capital and collateral more efficiently. Uchenna Uduji, ForexClear business manager, discusses…

BoE intervention whipsaws pension funds that dumped hedges

Unhedged funds saw liabilities rise by up to 20% when rates pulled back

Could a cold collateral winter be coming for pension plans?

UK LDIs passed an early test from rising rates, but margin call pressure is mounting

The rock-solid case for database marketing

With the right databases and intelligence, products can stand out above those of competitors

Forecasting the European Monetary Union equity risk premium with regression trees

The authors use EMU data from the period between 2000 to 2020 to forecast equity risk premium and investigate Classification and Regression Trees.

Don’t just reach for the ’70s inflation playbook – CROs

Lack of inflation experience on risk teams not a concern, buy-siders say