This article was paid for by a contributing third party.More Information.

The rock-solid case for database marketing

With the right databases and intelligence, products can stand out above those of competitors

The Covid-19 pandemic changed many of the ways in which we work and allocate our time and resources. This is perfectly exemplified through database marketing, where investment managers are increasingly using a strategic combination of both passive (database) and active (personalised outreach) marketing as an economic way to reach their target audience.

Why database marketing?

Well-executed database marketing strategies are an effective way to grow a firm’s presence in the market and a proven method for increasing brand recognition and product offerings. The ability to grow brand awareness is a compelling argument for database marketing. With face-to-face interactions not yet back to pre-pandemic levels, building a client community around a brand is difficult, and database marketing is one way of elevating a brand’s offerings in a market that can often feel saturated with direct marketing.

This was noted in Nasdaq’s eVestment white paper, Establishing an institutional brand: A guide to database marketing: “Database marketing is additive to personal outreach – it doesn’t replace traditional efforts to connect with consultants or institutional investors directly. It does, however, magnify the impact of the entire distribution function – sales, marketing, RFPs [requests for proposal] and consultant relations – through scale.”

Consultants and asset owners need to conduct extensive research and due diligence before making any decisions regarding asset allocation, and rely on databases as a key source of information to learn about a manager’s offerings and products. During these early screens – also known as shadow searches – a well-established and consistently maintained database helps with an investment manager’s presence. A strong database strategy can also ensure that even smaller managers are able to remain competitive in the field.

With environmental, social, and governance (ESG) considerations on the rise across the industry, there is a concurrent surge in ESG-focused product views within the data. As a result of this increased focus on ESG, investment managers can perform more targeted outreach and showcase their ESG standards and methodologies through their database marketing as another way to foster their client community.

Getting started

The first step in any database marketing strategy should be to identify the right databases to use. Those should be the ones used by any prospective allocators and consultants the asset manager is trying to reach.

Scale is of utmost importance. As described in the Nasdaq white paper: “Most firms take a phased approach and focus first on achieving scale. The top priority should be getting your strategies in front of as many consultants and asset owners as possible, then refining your targeting over time, based on your unique product line-up and distribution strategy.”

Using technology-enabled data population, a manager should then be able to push its data to multiple databases with automated validations and real-time success/error notifications.

Finally, managers should focus on continuous improvement through feedback intelligence. Key data to be considered includes where and on how many screens the firm’s strategies appear, the percentage of screens and the reasoning for why the product may be failing, and how competitors’ databases are performing. One of the critical points for evolving a database marketing strategy is to keep up with the ever-changing competitive dynamics of the market and adapt accordingly.

Nasdaq eVestment and Omni: partners for database marketing

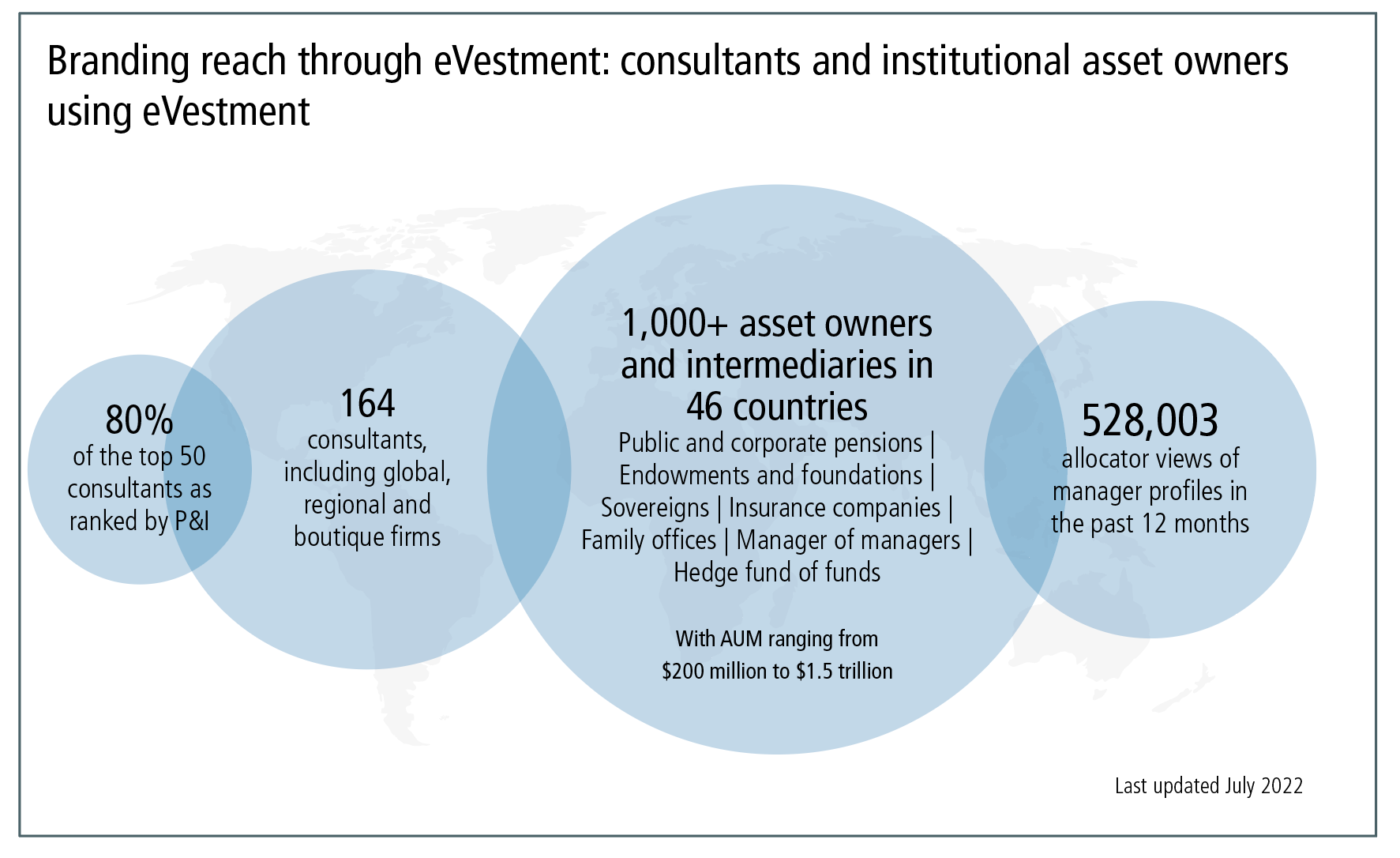

Omni is a Nasdaq eVestment database marketing solution that serves more than 500 fund managers across the investment industry worldwide and is relied upon by over 1,000 allocators and consultants, including the top 10 consultants globally.

More fund managers are implementing Omni to access a variety of niche databases so they can gain a broader range of visibility and best position their products to their target investors. Between 2019 and 2022, across the Asia-Pacific region, Omni witnessed a growth jump of more than 115% new fund management partners.

Establishing a strong database strategy is a key method for asset managers to get their products to stand out in a highly competitive market. Managers can conduct analysis on upwards of 25,000 peer strategies and gain a better understanding of how their brand compares to others in the market, which is highly valuable information.

On the flipside, consultants and investors are using eVestment to view, screen, compare and chart the various managers who are reporting to the databases, helping them make more informed decisions on their managers and their investments.

About Nasdaq’s eVestment

eVestment, a part of Nasdaq, provides institutional investment data, analytics and market intelligence covering public and private markets. Asset managers and general partners reach the institutional marketplace through the eVestment platform, while institutional investors and consultants rely on eVestment for manager due diligence, selection and monitoring. eVestment brings transparency and efficiency to the global institutional market, equipping managers, investors and consultants to make data-driven decisions, deploy their resources more productively and ultimately realise better outcomes.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net