Artificial intelligence

The AI bot that left the garage

Senior operational risk exec explains how hidden third-party feature could lead to systemic risk

Algos shrugged: AI uptake still lagging in bank op risk

Risk managers acknowledge transformative potential of artificial intelligence – most, from a safe distance

Japan FSA’s Ariizumi on Basel delays and regulating AI

Outgoing international affairs chief issues rallying call for Basel III adoption, saying Japan has “kept its promise”

Academic warns of systemic risk from AI-powered trading

Strategies generated by LLMs exhibit “very strange, correlated trading behaviour”, says Lopez Lira

Building reliable and successful LLM-based workflows

How AI is reshaping analytics, compliance and modelling in finance

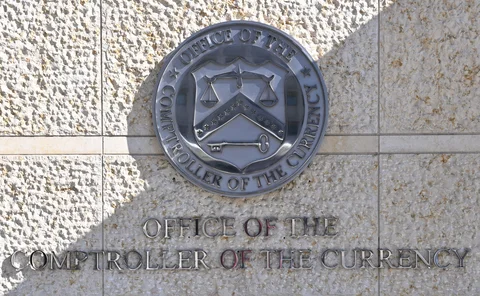

Former OCC chief on the sting of peeling the Basel III ‘onion’

Michael Hsu warns successors not to cut bank capital or neglect rate risks that destroyed SVB

Former regulator urges new approach to AI explainability

Ex-OCC chief Michael Hsu suggests shift from academic analysis to decision-based techniques

Hong Kong watchdog taps GenAI to monitor shadow banking risk

News headlines, social media and bank earnings calls all followed using in-house tools

Energy Risk Software Rankings 2025: ION Commodities interview

The outlook for energy and environmental markets, and ION’s strategy around AI

Stock-picking bots and models that don’t trade: AI at Vontobel

Early experiments are already bearing fruit, in sometimes surprising ways

AI in capital markets: bridging predictive precision with generative possibility

Regulatory requirements, compliance demands and concerns over data quality and consistency are prompting firms to approach AI with renewed caution and clarity

Brain drain at OCC raises concerns about US model supervision

Quant team cull will reduce capacity to validate bank models, but that could be part of the plan

Podcast: Villani and Musaelian on a quantum boost for machine learning

Classical methods struggle with highly dimensional problems. Quantum cognition takes a different approach, as hedge fund duo explain

Energy Risk Awards 2025: Nodal Exchange interview

Energy and environmental markets outlook, the impact of AI on power markets and Nodal Exchange’s plans

Deutsche Bank casts a cautious eye towards agentic AI

Risk Live: “An AI worker is something that is really buildable,” says innovation and AI head

Regulators urged to use Dora reporting to track systemic risk

Risk Live: Bankers and regulator say governance requirements for new rules are complex to implement

AI shows cognitive bias just like humans, tests show

Risk Live: New form of op risk may be “especially dangerous” for model validators, quant says

Why AI-enhanced risk management is vital for open finance

In bank-fintech partnerships, AI can be both a source of operational risk and a solution to it

Bank FX market-makers ramp up AI usage

Barclays applies tech to predictions, while HSBC and ING look at pricing accuracy

Citi close to launching GenAI investment tools

New tech will be used to improve investment recommendations and increase cross-selling

First Citizens used AI to retain SVB customers

Retention effort involved using AI to monitor customer behaviour and sentiment – including profanities

Are EU banks buying cloud from Lidl’s middle aisle?

As European banks seek to diversify from US cloud hyperscalers, a supermarket group is becoming an unlikely new supplier

Taking the sting out: exchanges and CCPs bolster scenario toolkits

As cyber threats ramp up, the world’s largest exchanges re-assume the worst

Technology is a double-edged sword for FMIs

Exchanges and clearing houses rely on third-party vendors for vital systems, but outsourcing can also lead to duplication and waste