Risk systems

Covenants: crisis of confidence

Financial covenants that rely too heavily on ratios are just not sophisticated enough to predict the likelihood of default, argues Sarah Woo. Loan originators must learn a trick or two from their colleagues in portfolio management and develop…

Covenants: crisis of confidence

Financial covenants that rely too heavily on ratios are just not sophisticated enough to predict the likelihood of default, argues Sarah Woo. Loan originators must learn a trick or two from their colleagues in portfolio management and develop…

Sarbanes-Oxley: The costly road to compliance

Some companies are looking to get a better return on their investment in Sarbanes-Oxley compliance by making it part of a larger exercise that looks at firm-wide processes and controls, and not just those surrounding financial reporting, writes Clive…

Covenants: crisis of confidence

Financial covenants that rely too heavily on ratios are just not sophisticated enough to predict the likelihood of default, argues Sarah Woo . Loan originators must learn a trick or two from their colleagues in portfolio management and develop…

The costly road to compliance

Sarbanes-Oxley

Briefs

Regulatory Update

Covenants: crisis of confidence

loan origination

Cutting capital

Across the banking spectrum, new technology is being used to help financial institutions reduce their capital requirements, writes Clive Davidson.

The score for credit

Jorge Sobehart and Sean Keenan discuss the benefits and limitations of model performance measures for default and credit spread prediction, and highlight several common pitfalls in the model comparison found in the literature and vendor documentation. To…

Portable alpha and beta for long/short equity managers

Portable strategies

Portable alphaand beta forlong/shortequity manager

Portable strategies

Sophistication and integration

Performance and risk

Major op risk software providers grow at expense of smaller rivals

Sales of operational risk solutions seem to be on the rise, but it is established vendors who are seeing deals close. Many small or new software houses in the op risk space seem still to be experiencing a lull in sales.

The deal deluge

Rankings 2004

Back to the futures

Derivatives

Mark-it set to offer new services as seven banks buy equity stakes

UK credit data provider Mark-it Partners plans to offer a convertible bond pricing service by the end of March, to complement its credit default swap, cash bond and syndicated loan pricing services. The move comes as seven of the company’s main backers…

Op risk systems come to the fore

Operational risk came to the fore in 2003. Major software suppliers such as SunGard and SAS entered the market through partnerships with or acquisition of early entrant developers, while a number of established trading and risk management systems…

Brokers look toshow their worth

Brokers are increasingly looking to provide energy price data. The choice may be wider, but are energy firms getting the credible data and analysis they need for intelligent price forecasts? Joe Marsh reports

Bursting with energy

Technology

All platforms

Electronic trading: Profiles

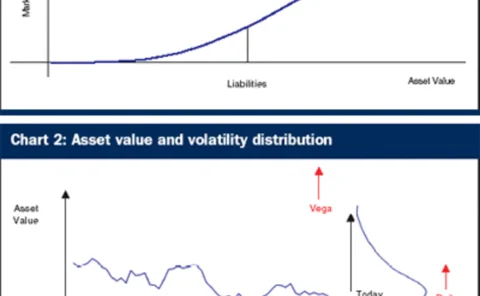

Pricing credit risk

Merton models