Pricing credit risk

The growth of the credit derivatives market has meant that Merton models are increasingly being used as a means of pricing both bonds and credit default swaps. Kate Birchall and Peter Zeitsch of ANZ Investment Bank analyse the evolution of these models

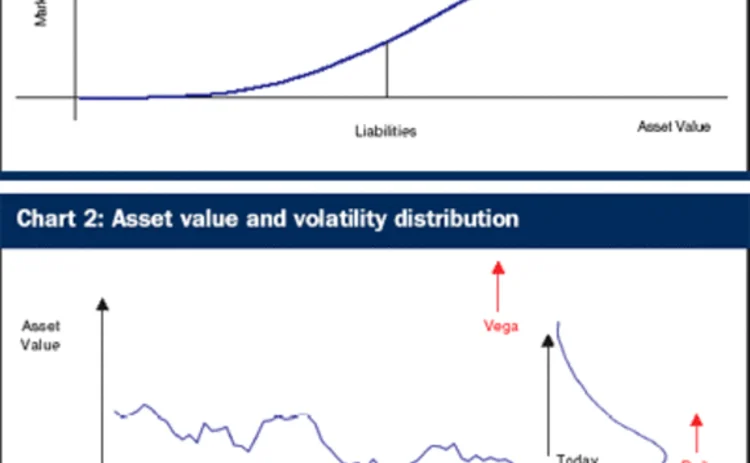

The measurement of credit risk is one of the most active areas of modern finance. The advent of credit derivatives has heightened the need to capture credit exposures even further. In 1974, the publication of Robert Merton’s academic paper1 introduced a new way of analysing corporate debt by linking it to a company’s market capitalisation, thereby quantitatively measuring credit risk. Effectively

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Esma to issue guidance on active account reporting

Briefing and Q&A aims to clarify how firms should report data ahead of RTS adoption

Forex looks to flip the (stable)coin

Friction-free foreign exchange is the prize offered by stablecoins such as Tether and USDC. But the prize remains elusive

Market warns BoE against blanket mandatory gilt repo clearing

Official says proposals receiving push-back on one-size-fits-all approach and limited netting benefits

Banks eye cost cuts ahead of RateStream Treasuries push

FX SpotStream’s move into rates seen as both fee-saver and potential boost to streaming execution

Real money investors cash in as dispersion nears record levels

Implied spreads were elevated to start 2026. Realised levels have been “almost unprecedented”

JP Morgan gives corporates an FX blockchain boost

Kinexys digital platform speeds cross-currency, cross-entity client payments

China eases cross-border grip in new derivatives rules

Lawyers hail return to a “more orthodox territorial approach” to regulating the market

Fannie, Freddie mortgage buying unlikely to drive rates

Adding $200 billion of MBSs in a $9 trillion market won’t revive old hedging footprint