ESG

Big banks love their climate vendors; small banks, not so much

Risk Benchmarking: Lenders with blue-chip loan books more likely to favour climate tools, research finds

Thrown under the Omnibus: will GAR survive EU’s green rollback?

Green finance metric in limbo after suspension sees 90% of top EU banks forgo reporting

Investors ignore ESG scores when hedging climate risks – Engle

The ability to withstand uncertainty matters more than green credentials, says Nobel laureate

Most banks add ERM heads – but CROs keep control

Hiring tilts towards AI, cyber and model risk as enterprise risk’s remit grows faster than its reach

The effect of environmental, social and governance disclosure on corporate investment efficiency

Investigating the impact of environmental, social and governance (ESG) disclosure on investment efficiency, the authors' findings suggest that nonfinancial disclosure mandates can alleviate capital rationing issues for underinvesting firms.

EC moots postponing 122 delegated acts to cut compliance costs

Secondary legislation from CRR, Emir and Mifir identified as suitable for unspecified delay

APG upbeat on sustainability derivatives despite setbacks

Isda AGM: Dutch pension fund manager’s chief executive believes instruments have room to grow

Why EU banks have snubbed revised green finance metric

Banks steer clear of Banking Book Taxonomy Alignment Ratio in droves

Default risk in the era of environmental, social and governance ratings: a comparative analysis of divergence

The authors investigate links between ESG ratings divergence and default risk, finding firms demonstrating better ESG performance show lower default risk.

Top 10 operational risks for 2025

The biggest op risks as chosen by senior practitioners – and what they’re doing about them

In search of a global ESG risk and reporting framework

Short summary: Banks are turning towards technology to improve ESG reporting and reduce related financial risks

Navigating carbon emissions markets

What the future hold for carbon emissions markets

Cool heads must guide financial regulation of climate risk

Supervisors can’t simply rely on ‘magical thinking’ of market discipline, says Sergio Scandizzo

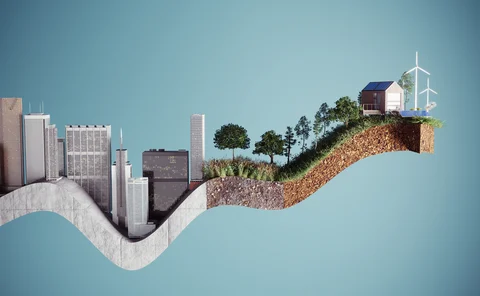

Riding the storm: banking in the era of climate risk

Climate-related risk is playing an increasing role in banks’ future strategies, resilience and prosperity

Strategies for navigating market volatility in the post-US election landscape

Market volatility following the US election, including inflation risks, commodities, geopolitical uncertainty, ESG considerations and the role of advanced analytics in investment strategies

Op risk data: Santander in car crash of motor-finance fail

Also: Macquarie fined for fake metals trade flaws, Metro makes AML misses, and Invesco red-faced over greenwashing. Data by ORX News

Sovereign risk manager of the year: Côte d’Ivoire

Risk Awards 2025: Dual-tranche $2.6 billion deal enables African sovereign to refinance costly private loans and improve debt sustainability

Man Group airs climate allocation tool for real-world decarbonisation

Compass is a guide for steering $200 trillion investment toward decarbonising high-emission industries

Physical climate risk threatens 15% of EU banks’ property loans

Erste, Helaba, BPCE most exposed to chronic and acute risks linked to climate change

Corporate ‘greenium’ reveals effect of ESG rules on returns

Analysis of sustainable products shows how SFDR has caused a shift in investor behaviour, writes economist

Sovereign ‘greenium’ differs more than you might think

Term structure data shows wide variation in yields for green sovereign debt, argues economist