Consumer finance

Top 10 operational risks for 2014

Internal failures will prove as dangerous as external threats for the financial industry in 2014

Republicans renew opposition to US consumer finance watchdog

Senate minority vows to block any and all CFPB directors, unless Congress is able to approve the agency's budget

US economy faces sluggish end to 2010

The Q2 slowdown in US growth is no short-term blip, according to investors.

Breaking the chains

The need to diversify customer credit risk and the rising importance of fiduciary standards make open architecture distribution vital to structured products’ future. As advisers become concentrated in bigger institutions and market volumes remain static,…

Wrap it up and start again

Marketing structured products is a tough challenge, with both nascent and established markets battered by the Lehman Brothers collapse. Meanwhile, providers must also adapt their techniques to suit interactive and online channels, and be increasingly…

BITS publishes new guidelines for Financial Services Aggregation

BITS, a Washington, DC-based non-profit consortium of 100 of the largest financial institutions in the US, has published new voluntary guidelines for financial services aggregation that promote sound, private and secure services.

S&P versus Basel II: A fragile accord

By publicly casting doubt over aspects of the Basel II Accord's methodology, rating agency Standard & Poor's is voicing concerns shared by many in the banking industry. Joanne Hart asks how this dispute may affect bondholders and the market in general.

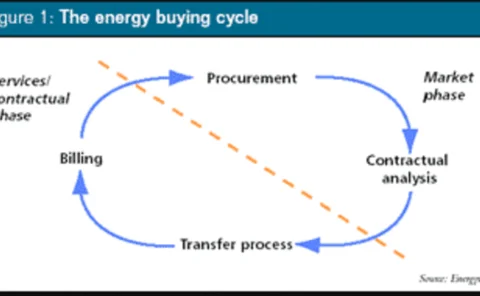

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes

Playing a waiting game

With energy – and particularly natural gas – costs on the rise, are end-users finally coming to terms with the importance of hedging or are they still waiting to get burned before they enter the hedging market? Kevin Foster reports

Banks should use Basel II delays to improve retail-lending systems

NEEDHAM, MASSACHUSSETTS - Banks should use the time gained by delays to the Basel II bank accord to plan for the replacement of systems that can’t handle the ever-increasing volume of loans to the retail sector, a report by banking technology consultants…