Operational risk

SEC whistleblower retaliation protection ambiguous, lawyer warns

Protection for whistleblowers not clear cut

The rising problems of PEPs

Instability in the Middle East and Africa coupled with growing regulatory pressure on financial institutions has raised the profile of political risk for banks – in particular, the problems of dealing with politically exposed persons, or PEPs, as…

Systemic operational risk since the financial crisis

A year of huge fines and settlements has thrown new light on the importance of controls and conduct risk

Benchmark survey and Lloyds/Bank of Scotland fine underline need for bonus scrutiny

£28 million penalty for poor incentives – but op risk still largely excluded from pay policies, survey finds

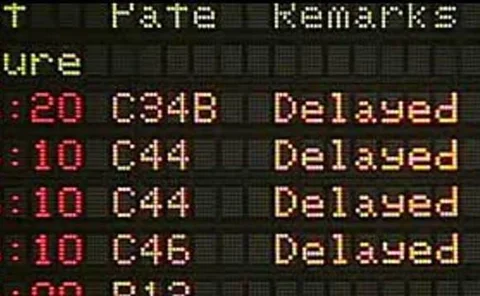

Schedule slips and costs rise on rate hedge payouts

UK regulator reveals that banks will miss deadline for compensating interest rate hedge mis-selling victims

Financial crime survey 2013

Sponsored survey analysis: BAE Systems Detica

Meeting the challenge of bribery and corruption in Africa

Andrew Legg, senior litigation partner at global law firm Eversheds, examines the challenges businesses can face when navigating the issue of bribery in Africa and calls on the experiences of organisations already tackling the issue at the sharp end

Integrating operational risk into business management

Sponsored webinar: MetricStream

'Zero-loyalty environment' blamed for financial malpractice

Lack of leadership and job insecurity are behind widespread wrongdoing in the financial sector, seminar hears

Top five losses: JP Morgan hit by $5.1bn settlement

Operational risk loss data – October 2013

Accountability crucial for internal governance

Pickpockets or cyclists?

Building better benchmarks in Dubai: DME's Chris Fix on running an oil exchange

Top of the agenda for the Dubai Mercantile Exchange and its chief executive, Christopher Fix, is assuring the integrity of its crude oil benchmark. He talks to OpRisk about the operational challenges stemming from the exchange’s unique regulatory…

Control weaknesses continue to plague banks

The primary concerns for operational risk managers in 2014 include data theft, index rigging and reputational risk, but many have one thing in common – weak internal controls

Top 10 op risks: tighter consumer regulation

The last in our series of top 10 op risks for 2014 looks at tighter consumer regulation. An industry plagued by scandal will now face closer regulatory attention on its retail side

Top 10 op risks: culture of complicity

The ninth in our series of top 10 op risks for 2014 looks at culture of complicity. Criminal investigations have revealed disturbing common features in many recent scandals

Sants quits Barclays after just 10 months in compliance role

Ex-regulator and head of compliance quits UK bank citing stress

Top 10 op risks: reputational risk

The eighth in our series of top 10 op risks for 2014 looks at reputational risk. Admissions of guilt expose banks to more than simply public displeasure

Handling the risks of rapid recruitment

An unprecedented recruitment process has taken place in recent years to handle the payment protection insurance scandal. The financial services industry has had to rapidly embrace the challenge of hiring staff in their thousands, but lessons learnt from…