Operational risk

Greenspan says Basle II could reduce extremes of business cycles

BASLE II UPDATE

UK could require more op risk capital from insurance firms from 2004

INSURANCE REGULATION

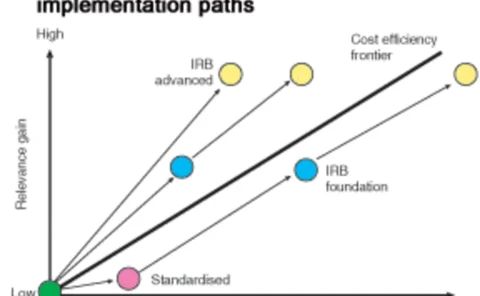

A cost/benefit approach to Basel II

The cost of implementing Basel II could put banks at a competitive disadvantage compared with non-banks, and spur them to ‘de-bank’ to avoid this regulatory burden. Harry Stordel and Andrew Cross say regulators must look at the provisions from a cost…

The benefits of Enron

Many corporations are keeping a low profile when it comes to their derivatives use. But when the Enron-related witch-hunts are over, companies may find that insurers and shareholders now view corporate hedging as a fiduciary duty

France develops new code of conduct for alternative investment

French investment boutiques are set to benefit from the country's planned relaxation of fund regulation

The Impact of Basle II on the Dealing Community

Overlook the implications of Basle II at your peril, says Garfield Hayes, head of marketing communications at Wall Street Systems.

Credit risk in asset securitisations: an analytical model

How much capital should banks reserve against investments in portfolio securitisations? Asserting that recent proposals on this subject by Basel are inconsistent, Michael Pykhtin and Ashish Dev propose a new analytical model suitable for tranches of…

Revamping Corporate Actions

Dividend payments, stock splits, name changes, spin-offs and other corporate actions impacting securities already held in accounts were not supposed to be affected by T+1. But as the deadline for shortening the trade settlement cycle is challenging firms…

Gaining an edge from Basel

The recent recommendations of the Basel Committee are set to usher in a period of upheaval for many participants in the banking sector. Standard & Poor’s Anthony Albert looks at how to gain a competitive advantage in credit risk management in the light…

Static data moves forward

Firms tackling high-speed and information-intensive tasks such as straight-through processing or risk management without accurate instrument and counterparty reference data may be taking enormous operational and credit risks. Clive Davidson reports on…

East European banks could pay Basle II dividend

BASLE II UPDATE

EU bank regulation debate intensifies

BASLE II UPDATE

Regulators plan trio of Basle II papers for October

BASLE II UPDATE

The Basle II capital accord: op risk proposals in brief

BASLE II UPDATE

Electronic swap trades use FpML for first time

TECHNOLOGY NEWS

Losses and lawsuits

LOSS DATABASE

Static data moves forward

Firms tackling high-speed and information-intensive tasks such as straight-through processing or risk management without accurate instrument and counterparty reference data may be taking enormous operational and credit risks. Clive Davidson reports on…

Mixed outlook for derivatives staff

After a disappointing 2001, the job market for derivatives specialists looks set to rebound this year in certain areas, while other areas remain stagnant or face even further declines. Gallagher Polyn identifies the hot spots and those areas to avoid in…

EU officials act on post-Enron policy issues

European Union (EU) finance ministers and central bankers ordered a review on Saturday of the supervisory issues for derivatives trading and the preparation of financial data to try to avoid any Enron-like collapses in Europe.